What the Experts Are Saying About Investing In This Stock Market

Investing

By: Greg Maxwell

If you invest in the big US stock markets, I have some important news…

The US markets are in Bear territory.

Well… that's not news, but what lies underneath that statement could have a profound effect on your portfolio.

You see, this is something we only get to write once every 10 years or so.

It's simple, and compelling…

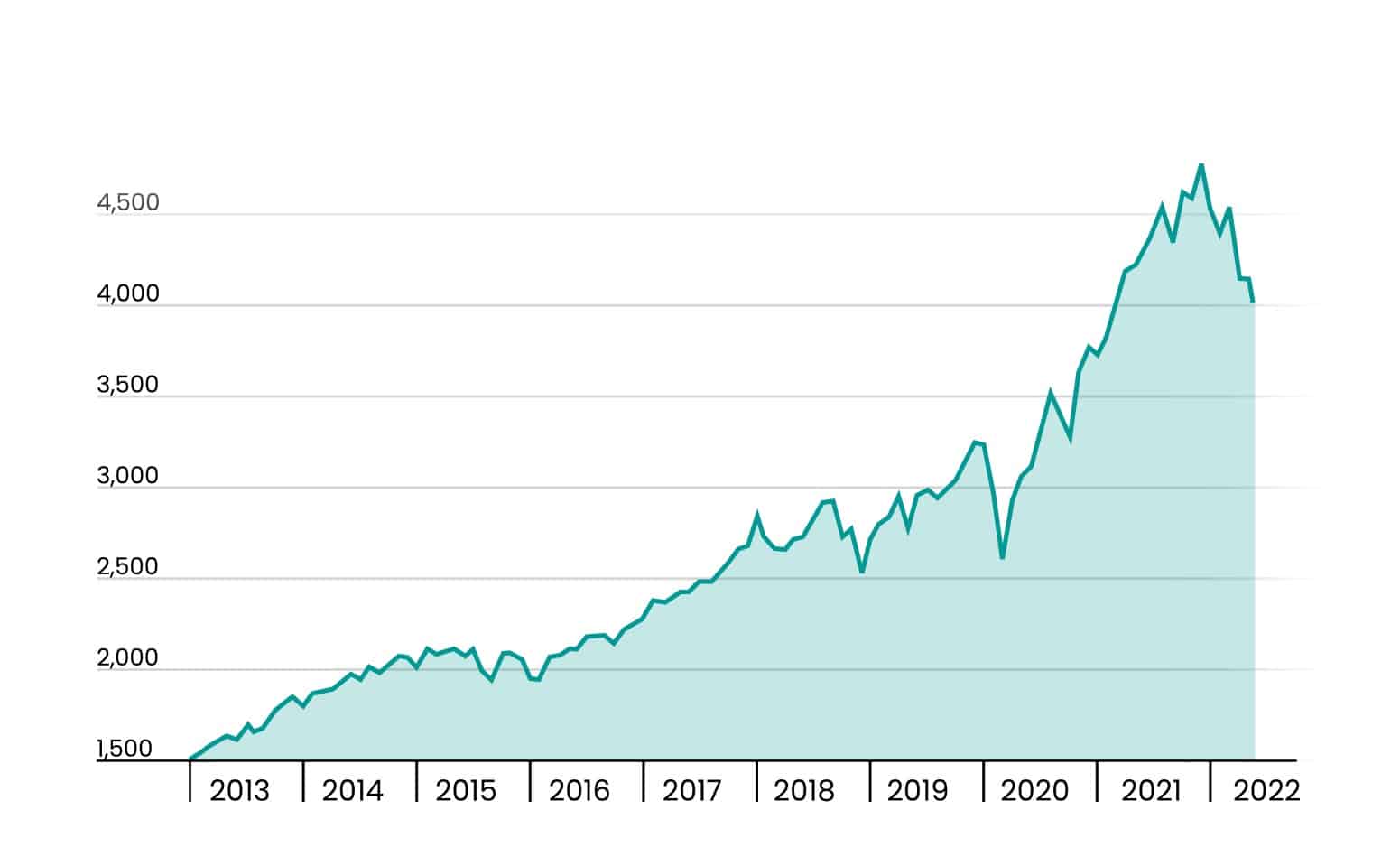

As you can see in the chart above, the US market has taken some big hits recently.

And at the low levels some companies have fallen to – we're facing what could potentially be one of the best investing opportunities in the US, since the Global Financial Crisis.

I'm not alone in saying that…

Wedbush Securities' Dan Ives told CNBC that it's a "generational buying opportunity" for the right stocks.

Billionaire investor Ron Baron admitted in a CNBC interview that it's a "huge, monstrous opportunity."

Longtime columnist and author Mark Hulbert said in Marketwatch that "fortunes may be made by those that are dispassionate and selectively buy today."

Hulbert goes further summing up the reasons why so many smart investors are excited: Stocks have historically returned an average of 22.7% in the year after entering a bear market…

Which is what the US markets did recently.

So, if you believe the market will eventually go back up and surpass its highs (as it's done after every bear market in history… again, study the chart above) …

Hulbert says, "purchases made now will show a bigger profit, and sooner, than the market itself."

Put another way… The S&P 500 has gained over 339% since the bottom of the financial crisis bear market of 2008 – 2009.

Don't regret missing out

If you're already invested in US stocks right now, I know it can be tough to experience a bear market…

It can also be tempting to tell yourself "I'll just wait until stocks are going back up to invest."

Problem is… It simply doesn't work that way. You simply cannot tell the everyday zigs and zags from "we've hit bottom and stocks are going back up for good."

Which means people who try to time the market usually end up missing the big gains they were hoping to get in the first place.

Neither I, nor the people I just mentioned, are saying this is the exact bottom of the US market. The truth is, no one knows for certain where the market will go in the short term. So it's futile to try and time it.

But there is a silver lining…

You see, I'm a huge believer in the long-term direction of the US economy, and of the US stock markets…

Because of this – the reason for this article today – is to urge you to invest in the market with a long-term strategy… and not look back and kick yourself for the gains you missed out on.

Where to invest?

If you want to know where to invest right now, adding regularly to an ASX, S&P 500 or market index fund is a good place to start.

I'd also recommend taking a strong look at The Motley Fool Australia's flagship investing service, Share Advisor.

You see at Share Advisor, we give independent Aussie investors the best of both worlds! That's two stock recommendations every month – One ASX and one US pick.

I should also tell you, our monthly recommendations have handily beaten the Australian All Ords benchmark as well as the US market where it's crushing the returns of the S&P 500.

In other words. As of 20 January, 2023, our average US pick has beaten the S&P by an average of 55 percentage points!

And, as of 27 July 2024 those returns right now include:

- Netflix recommended in July 2012 has grown 43% per year (total return of 7,433%)

- Corporate Travel Management has grown 17% per year since recommending in August 2012 (total return of 570%)

- ResMed recommended in May 2013 has grown 19% per year (total return 629%)

- Amazon has grown 27% per year since recommending in February 2012 (total return of 1,911%)

Granted, I'll be the first to admit that not all of our picks have been — or will be — such big winners…

And these are some of our best performing picks.

As you may know in the world of investing – there are never any guarantees…

However, I'm sure you'd agree that returns like these show the power of long-term investing through bear markets, bull markets, and everything in between.

So, if you're looking at the US market and wondering which companies are potentially screaming buys right now…

Then you'll need to check out Share Advisor's 4 best US "Pullback Stocks" to buy right now,

To find out more, simply enter your email below.

Returns as of 27 July 2024. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. The Motley Fool Australia's parent company Motley Fool Holdings Inc. has positions in and has recommended Amazon, Netflix, and ResMed Inc. The Motley Fool Australia's parent company Motley Fool Holdings Inc. has recommended ResMed. The Motley Fool Australia has positions in and has recommended ResMed Inc. The Motley Fool Australia has recommended Amazon, Corporate Travel Management Limited, and Netflix. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips. For more information about The Motley Fool see our Financial Services Guide. All returns cited are hypothetical and based on the percentage change between the stock price at the time of recommendation and the current or sell price (if the position has been closed) at the time of publication. Brokerage, taxes and any other associated costs are not taken into account. Please remember that investments can go up and down. Past performance is not necessarily indicative of future returns. Performance figures are not intended to be a forecast and The Motley Fool does not guarantee the performance of, or returns on any investment. Any money back guarantee is strictly limited to the subscription price paid for the product.