At a time when most investors are selling in fear of the current bear market, one of Silicon Valley's most iconic companies is doing the exact opposite.

On 20 April 2022, the Board of Directors at Alphabet Inc (NASDAQ:GOOG) – the parent company of 'Google' – decided to be greedy when others were fearful of authorising the repurchase of an additional US$70 Billion of its own shares.

This was a significant acceleration of an already large share buyback program and it reflects a material increase from the US$50 billion authorised in 2020 and the US$25 billion authorised in 2019.

Google's new plan will operate concurrently with its existing repurchase program, which still has $4 billion in authorised buybacks remaining.

Aside from Apple (NASDAQ:AAPL), Google repurchased more of its own stock than any other public company in 2021. With a market cap that is 40% smaller than Apple, Google certainly punches above its weight when it comes to the scale of its buybacks.

As a reminder, all else being equal, share buybacks reduce the number of issued shares which means that remaining shareholders own a larger portion of the business. Share buybacks also (all else being equal) increase a company's the earnings per share.

So whilst everyone is selling, Google is buying billions of dollars of its own stock.

Which begs the question, what does Google know that we don't?

There is an old saying on Wall Street that there are many reasons why insiders at a company sell their shares, but there is just one reason why they buy.

Because they believe that the shares will go up!

Share buybacks are often employed when the company's Board believes that its shares are materially undervalued by the market.

Whilst investors know how profitable Alphabet's main businesses like Google Search, YouTube and Google Cloud are; very little is known about the company's 'other bets' segment.

The company's 'other bets' are early-stage investments into various technologies like autonomous vehicles, biotechnology, the internet of things and the highly secretive R&D facility called Google X moonshot factory.

Could it be that Google's Board believes that the market is undervaluing not only its main businesses but is completely disregarding its other bets?

Let's take a closer look at the story of Google.

Founders Larry Page and Sergey Brin suspended their PhD studies at Stanford University to start up Google over two decades ago, and in that time has become one of the world's most successful companies.

From its humble beginnings operating out of a garage in California, Google has evolved into a collection of several hundred companies and start-ups. The conglomerate is home to many familiar names including Google Maps, Google Cloud, Android and YouTube.

Widely regarded as the company most responsible for shaping the modern internet, Google has truly been a game changer. Its current unique asset base, which spans across several internet properties, positions it exceptionally well for further growth acceleration.

Google is not like the rest. During the first quarter, its results distinguished it from other companies such as Amazon (NASDAQ:AMZN), which were heavily impacted by rising costs.

For the period, it delivered US$68 billion in revenue, up 23% from the equivalent prior period.

While Google is somewhat diversified, the majority of its revenue is generated from advertising generated via its Search business. For Q122, Google Search provided US$39.6 billion in revenue, up 24% on Q121

Despite its overall success, there were some challenges during the quarter that should be acknowledged. Its YouTube ad revenue underperformed due to increased competition in the Social Media space, which may be an area of the business facing a slowdown. The war in Ukraine also negatively impacted ad spending in Europe, however, this is more likely to be a short-term issue. Looking ahead, post-pandemic retail and travel business recovery is likely to drive the growth of Google's search business.

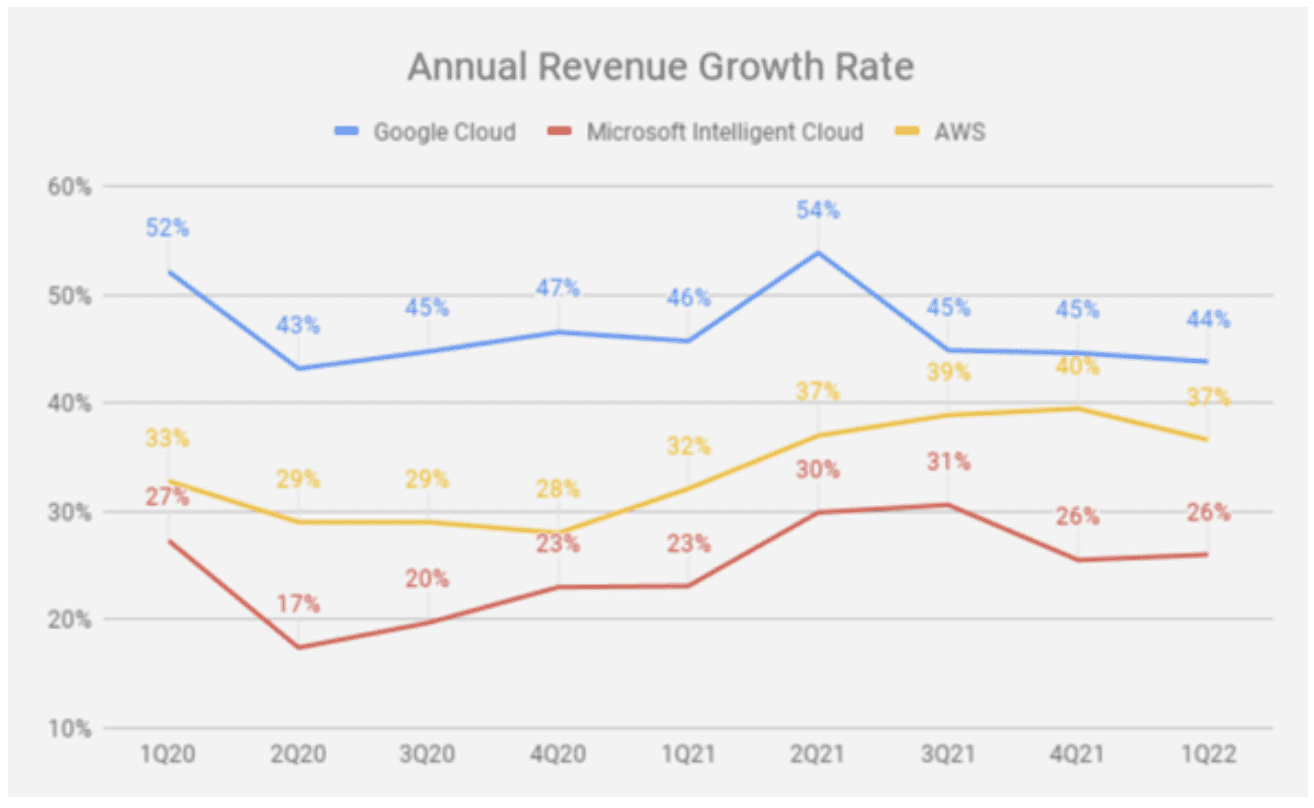

Unlike many mature companies, Google continues to innovate rather than sit still. Its Cloud and Other Bets divisions offer the serious potential to deliver continued growth for the company. These divisions posted a combined US$6.2 billion in revenue in Q122, marking a 50% increase from the previous equivalent period. Currently, Google Cloud's market share is just 8%, compared to AWS at 33% and Azure at 21%. However, its revenue is growing faster than its competitors (see figure below). The company has also been investing heavily in equipment and human capital to increase its market share. Typically, this is an excellent recipe for success and can offset other areas of the business that may be slowing down.

Source: Seeking Alpha, 2022

Similarly, Google's 'Other bets' division, made up of emerging companies at various stages of development, including GV X, Verify and Waymo exhibits high potential. Taking a closer look at Waymo, for example, it is regarded as a leading autonomous driving company. And considering the implied value of Tesla's self-driving business, Waymo could be worth a lot!.

Over the past 12 months, Google has generated US$69 billion in free cash flow. Based on a market cap of US$1.55 trillion, this is a price-to-free cash flow of 22.5, even as Google Cloud and Other Bets divisions both continue to burn through cash. So naturally, once these divisions start generating profits, Google's free cash flow will be considerably higher, making Google's future prospects seem particularly attractive.

Price vs value

The tech sector has certainly come under considerable pressure in recent months. Driven by inflation, rising interest rates, a war in Europe and supply chain issues, the Nasdaq has declined by more than 20% from the start of the year. Many stocks in the Nasdaq-100 are down more than 50%, a daunting reality for many investors.

As of May 2022, Google is down by almost 30% from its 52-week high, with the majority of that decline occurring from the start of this year.

Is Google really worth 20-30% less than it was at the start of the year?

We think not. And neither does Google, apparently, evidenced by the magnitude of its new repurchase plan. A reminder – companies only typically conduct buybacks when they believe their stock is undervalued. Spoiler – Google sees big things ahead!

2022 started with a major sell-off in the equities market. However, we believe the biggest mistake investors can make during a correction is to sell stocks after a big decline. This increases the likelihood of permanent capital loss. Even after the GFC, the majority of investors who stayed in the market were able to recover their losses within a few years. And, any investor who sold out after the collapse of Lehman Brothers would not have been able to recover their losses by switching to other asset classes.

Instead, Investors should be following Google's lead and looking for opportunities.

Google has roughly US$170 billion in cash and minimal debt. The company's US$1.5 trillion market capitalisation means that approximately just over 10% of its market cap is held in cash. Google also has a relatively low price-to-earnings (PE) ratio (in the low 20s), supported by double-digit revenue growth and even faster earnings growth. So, ramping up the scale of its buyback scheme at this point in time makes perfect sense.

Market downturns are never fun (or easy). And every decline comes with its own set of challenges. That being said, whether it be Google or another business with long-term potential, we believe there are many opportunities out there to be found.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. The Motley Fool Australia's parent company Motley Fool Holdings Inc. has positions in and has recommended Alphabet (C shares), Amazon, and Apple. The Motley Fool Australia's parent company Motley Fool Holdings Inc. has recommended Alphabet (A shares) and has recommended the following options: long March 2023 $120 calls on Apple and short March 2023 $130 calls on Apple. The Motley Fool Australia has recommended Alphabet (A shares), Alphabet (C shares), Amazon, and Apple. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.