This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Last Thursday night, electric vehicle (EV) pioneer Tesla (NASDAQ: TSLA) unveiled its much-anticipated robotaxi -- actually, 21 of them -- called the Cybercab. The two-seater vehicle suggested a Tesla Model 3 in the front and the futuristic-looking Tesla Cybertruck in the rear. It's purpose-built as an autonomous vehicle, so it has no steering wheel or pedals.

As usual for a Tesla new product reveal, CEO Elon Musk whipped up a lot of excitement among investors and tech enthusiasts prior to the event. Fittingly, the event occurred at Warner Bros. Discovery's movie studio in Burbank, California, and indeed it was impressive from a theatrical standpoint.

Tesla's event was light on detail, resulting in Tesla stock dropping and ride-hailing stocks surging

Tesla stock dropped 8.8% on Friday, a day in which all major stock indexes rose, which didn't surprise me. When the event ended for streamers, my immediate thought was, "That's it?" (Tesla stock edged up slightly Monday and Tuesday, but it is still 8% lower as of Tuesday's market close than it was prior to the robotaxi event.)

While investors were dumping shares of Tesla on Friday, they were also buying shares of ride-hailing leaders Uber Technologies and Lyft, which surged 10.8% and 9.6%, respectively. Tesla provided scant details during its event about its plans to start a ride-hailing service using self-driving Tesla vehicles, which investors naturally viewed as positive news for Uber and Lyft, as these companies are well-positioned to be leaders in operating ride-hailing services using autonomous vehicles.

Musk's remarks lasted only about 20 minutes, at least for streamers. There were approximately 3.4 million of us watching on Tesla's X (formerly Twitter) feed. That said, the festivities did continue longer for attendees, who were served drinks by Optimus robots and could take a spin around the expansive movie studio set in a Cybercab or a driverless Tesla Model Y.

Given this critical take, it seems worth noting that I think I'm quite objective when it comes to Tesla. Indeed, my review of its second annual Artificial Intelligence (AI) Day, held in October 2022, was moderately positive. My two main takeaways:

Musk is well known for having many grandiose plans, some of which will probably not go beyond the development stage. That said, it seems more likely than not that Tesla will eventually sell humanoid robots [its Optimus robot] at scale.

Tesla investors have to like that Musk thinks big. Being an early entrant into any massive secular trend can provide a company with a considerable and often lasting early mover advantage.

Tesla greatly needs its Cybercab and ride-hailing service to be successful

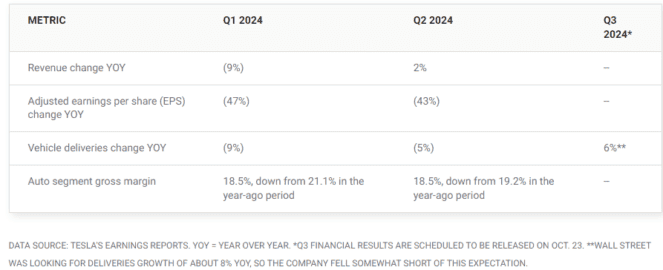

Tesla has recently been struggling to grow EV sales, which stems from a slowdown in the overall EV market and increasing competition. It's been lowering prices to boost sales, which has hurt margins and earnings.

While the company's energy and "existing services and other" segments have been performing well, they are not likely to be enough to power Tesla stock higher over the long term. So, the company needs its Cybercab and ride-hailing service to be successful -- and it needs to launch this vehicle as soon as possible.

On that note, Musk said during the event that he expects Tesla to start production of the Cybercab "before 2027." That timeline seems overly optimistic, as does his expectation that the vehicle will cost "below $30,000." Musk also shared that he anticipates Tesla will begin operating fully self-driving vehicles -- Model 3s and Ys -- in California and Texas next year. Of course, this timeline will be dependent upon regulatory approvals.

Tesla is behind in the robotaxi space right now, but that doesn't mean it won't eventually catch up to or even eclipse the leaders, including Alphabet's Google, whose Waymo business has to be considered the leader in the United States.

Tesla stock investors will likely now be more demanding on October 23

Tesla is scheduled to report its third-quarter results after the market close on Wednesday, Oct. 23. After the disappointing robotaxi event, investors will probably be more demanding of Tesla's Q3 results and the data that Musk shares on the earnings call.

Tesla stock trades at 72 times forward earnings, a very lofty valuation for a company that Wall Street expects will grow earnings over the next five years at an average 12% to 15% annually, depending upon the source. Other valuation metrics also suggest a significantly overvalued stock. The stock's high valuation reflects that many investors expect Tesla to speed by Wall Street's earnings estimates, at least over the long term.

Tesla stock seems at risk of taking another big hit if Musk and his team don't overdeliver -- at least on what data is shared on the earnings call -- next Wednesday. Here are Wall Street's Q3 expectations for the top and bottom lines:

- Revenue of $25.33 billion, or growth of 8.5% year over year

- Adjusted earnings per share (EPS) of $0.58, or a decline of 12.1% year over year

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.