It's that exciting time of the year again when many ASX-listed companies spill the tea on their latest financial results. Coincidentally, the reporting season aligns with an inundation of dividends from some of the biggest shares in the S&P/ASX 200 Index (ASX: XJO).

Typically, companies will declare the amount they intend to pay as a dividend with the delivery of their results. This is partly due to the reliance dividends have on the company's results. Whether an ASX share achieves earnings above or below guidance can be the difference between a juicy payout or a paltry one.

As we hurtle toward the busy part of the ASX reporting season, we take a look at the ASX 200 shares that might be considered dividend heavyweights.

What will dividend disciples be dealt?

For investors who are geared more toward income, the weeks to ensue will be a white-knuckled ride. As pointed out in a Livewire article by Alastair Macleod of Wheelhouse Partners, a handful of ASX 200 companies wield a disproportionate portion of the total dividends to be paid over the next month.

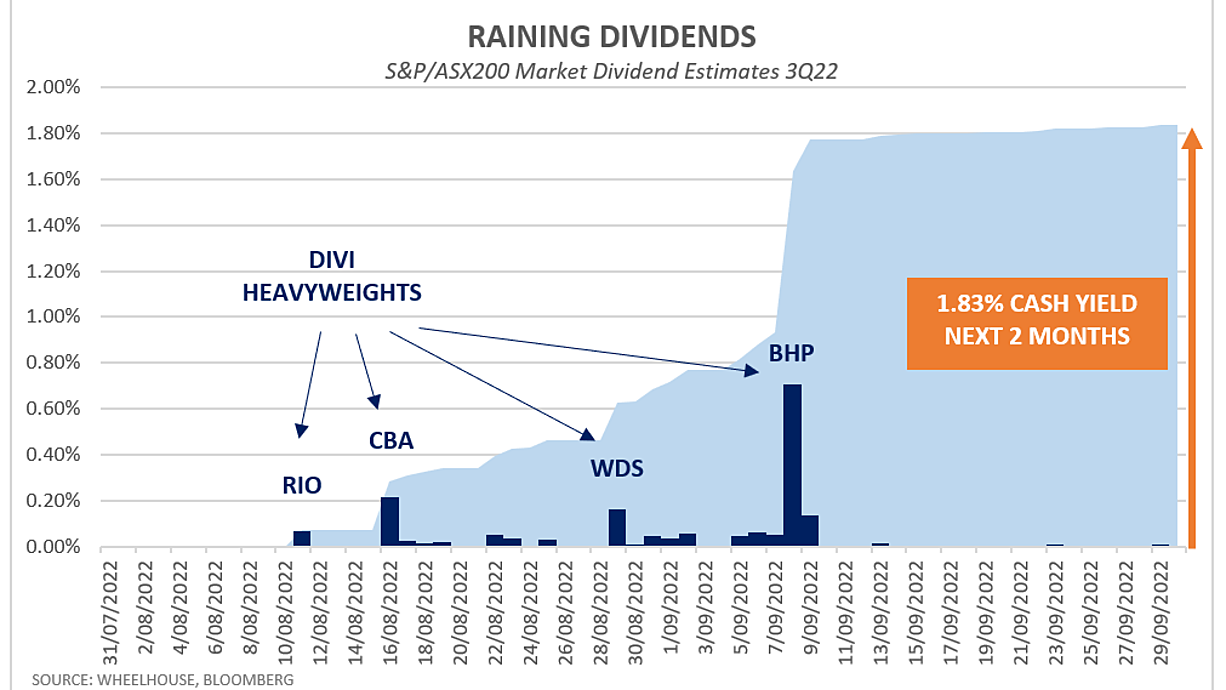

It is a pivotal time for investors looking to cash in on dividend payouts. To paint the picture, 113 of the 200 constituents of the benchmark index are slated to go ex-dividend by 30 September. Within this, there are four ASX companies that Macleod highlights as 'dividend heavyweights'.

Unsurprisingly, commodity giants Rio Tinto Ltd (ASX: RIO) and BHP Group Ltd (ASX: BHP) are on the list. Meanwhile, the other two ASX 200 shares fitting the bill are Commonwealth Bank of Australia (ASX: CBA) and Woodside Energy Group Ltd (ASX: WDS).

However, the first cab off the ranks — Rio Tinto — surprised investors last week. The company slashed its interim dividend by 52%. Although, shareholders will still receive $3.837 per share in dividends on 22 September.

Alas, the remaining 'dividend heavyweight' contenders are yet to report. For those interested, here are the reporting dates:

- Commonwealth Bank of Australia — 10 August

- BHP Group — 16 August

- Woodside Energy — 30 August.

How important are these ASX 200 shares?

Macleod provides an insightful chart in his article, which we'll reference here. As depicted, the four ASX 200 dividend shares listed above are expected to be key to the total payouts.

The chart above reflects consensus estimates among analysts for near-term dividend payouts. Furthermore, we can roughly estimate that nearly 63% of the total 1.83% cash yield projected will be comprised of dividends from Rio, Commonwealth Bank, Woodside, and BHP.

Only time will tell whether these ASX 200 shares can live up to the expectations.