ASX lithium shares could power up on the back of an upgrade by a leading broker.

The upcoming introduction of Euro 7 standards by the European Union is a key reason behind Macquarie Group Ltd's (ASX: MQG) decision to lift its forecasts for the battery making commodity.

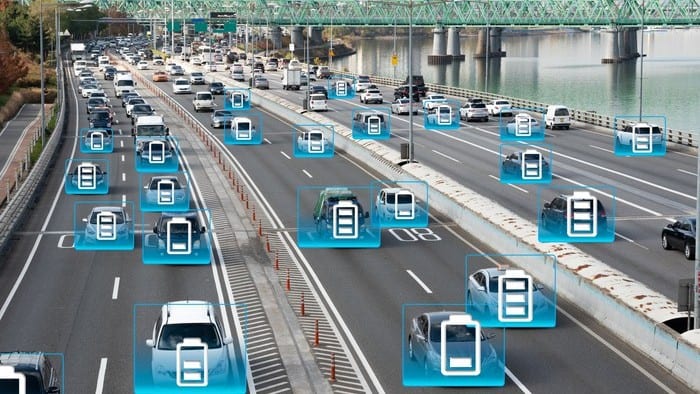

Euro 7 could accelerate phasing out of combustion engines sooner rather than later.

The new standards should be the final policy prior to all cars becoming zero-emission in the EU.

Stronger battery demand powers upgrade for ASX lithium shares

"The Macquarie commodity strategy team took a deep dive into the ESS market and raised 2021-23E battery demand forecasts by 13%/13%/17%, with policy tailwinds and lower battery costs," said the broker.

"The team saw lithium carbonate, dry separator and iron phosphate precursor players as key beneficiaries."

Combustion engines decelerating

The major car manufactures have already made plans to go all electric over the coming years. Audi was one of the latest. It will stop making internal combustion engine (ICE) vehicle in 2026.

"We believe this is part of Audi's preparation for the upcoming Euro 7 emission standards, which could be implemented as early as 2025," added Macquarie.

"While details of Euro 7 are still work in progress, it is reported that the stricter option being studied could see CO2 and NOx limits halved from the current level."

What's more, the introduction of Euro 7 is likely to put pressure on other countries to adopt tighter emission standards too.

This in turn will hasten the adoption of electric vehicles at the expense of those with combustion engines.

ASX lithium shares that are key buys

The more bullish outlook for batteries prompted Macquarie to make material earnings upgrades for ASX lithium shares.

The picks of the sector are those with domestic operations, which will benefit from the weaker Australian dollar.

These ASX shares include the IGO Ltd (ASX: IGO) share price and Pilbara Minerals Ltd (ASX: PLS) share price.

Macquarie is recommending investors buy both shares with a 12-month price target of $9.50 and $1.80 a share, respectively.

Bright outlook for M&A candidates

Having said that, the broker is also favourably predisposed to the Galaxy Resources Limited (ASX: GXY) share price. This is ahead of its merger with Orocobre Limited (ASX: ORE).

Both of these ASX lithium shares are rated "outperform" by Macquarie. The broker's 12-month price target on the Galaxy share price is $4.70 and Orocobre share price is $7.80 a share.