I've been looking through the share prices of some ASX dividend shares recently, and a strange pattern has emerged to my eyes. Some ASX dividend share prices just don't go anywhere. Sure, there's the normal ups and downs that a listed ASX share will always have. But a view of the long term can sometimes put things into perspective, and sometimes not in a good way. We all expect our ASX shares to go up over time.

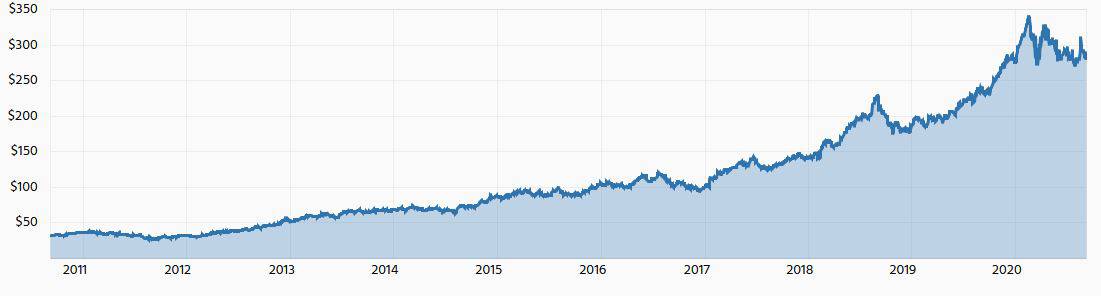

I mean, that's why we spend good and hard-earned money on them and not on things that depreciate in value over time, like fancy clothes or sweet cars, despite the nicer hit to our instant gratification. Take this pricing graph of CSL Limited (ASX: CSL):

That's probably what we all hope for in an ASX share.

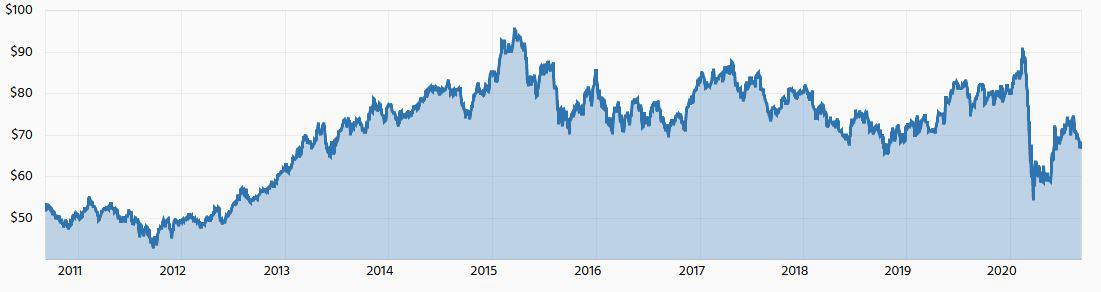

But the picture isn't quite as rosy for some other famous names on the ASX. Just take a look at this graph of the Commonwealth Bank of Australia (ASX: CBA):

Not such a pretty picture. Yep, if you look closely, you can see that the CBA share price is going for roughly the same as it was in 2013. That's 7 years of not a whole lot. Here's another ASX bank to compare it with in Westpac Banking Corp (ASX: WBC):

Perhaps that's just the ASX banks though? Well, how about Woolworths Group Ltd (ASX: WOW)?

Again, not too impressive, given you could have picked up Woolies shares for around today's price back in 2014. That is unless you managed to buy the dips and sell at the peaks (not a strategy I would recommend pursuing).

AGL Energy Limited (ASX: AGL)? Read it and weep:

So what's going on here?

The pitfalls of a dividend-paying ASX share

Westpac, CBA, Woolworths and AGL are all ASX shares with a reputation for providing heavy dividend income. Some ASX investors will know that when a share goes 'ex-dividend' (that is, eligibility for the next dividend payment gets closed), the share price will drop the following day by (usually) a comparable amount. That's because dividend payments actually weaken the company. It's literally money going out the door and out of the business, never to return. Now, I believe a strong company like CSL has enough growth opportunities to be able to fund expansion and still be able to pay a dividend. That's why its share price has climbed so high over the past decade.

But unfortunately, that's not the case with many other companies. For these companies, maximising their shareholder payouts is the primary goal of management. That leaves little to no cash for growth opportunities. On one level, that's fair enough. There's only so much growth available to mature companies like AGL and Woolworths. There comes a point where it's better and more productive to pay a dividend than build Sydney's 100th Woolworths store or Melbourne's 200th Westpac branch.

But investors in these companies need to know they are signing up for a robust dividend and not much else. And even that has been thrown into doubt in 2020, a year in which Westpac won't even be paying a dividend. Something to keep in mind, fellow income investors!