If you're anything like me, you're probably hoping your investment in ASX shares will make you a millionaire. But when the S&P/ASX 200 Index (ASX: XJO) plummets lower it can make you question your investment strategy.

But the reality is that the maths behind investing is quite straight forward. Let's take a look at how ASX shares can help you become a millionaire by the time you reach retirement.

How to use ASX shares to become a millionaire

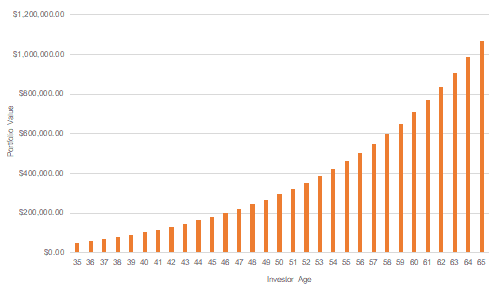

Let's check out an example to demonstrate. Consider your average 35 year old investor with a diversified ASX share portfolio. To keep things simple, we'll ignore taxes and brokerage on shares and assume an 8% per annum average return with dividends reinvested.

This average investor starts with $50,000 in ASX shares and adds $5,000 per year to his portfolio.

What we can see is that, through the magic of compound interest, his investment in ASX shares can most definitely make this investor a millionaire by the retirement age of 65. Even 10 years prior to retirement, this ASX share portfolio is worth $461,858. However, by retirement age, the portfolio has more than doubled to $1,069,549 and the investor has become a millionaire.

How can you do the same with your ASX share portfolio?

So, what does this example really tell us? The answer is that a diversified share portfolio and long-term outlook can really pay off in the future.

While the Afterpay Ltd (ASX: APT) share price might have rocketed 400% higher since mid-March, it's not a wise strategy to put all your eggs in one basket.

By constructing a portfolio of high-quality ASX shares and holding for decades ahead, you could generate the 8% per annum average return illustrated in this example.

Of course, it's wise to invest only what you can afford to lose. You don't want to be forced to sell at a bad time because you over-invested and suddenly need that cash back.

It's also important to remember that it's never too late to start investing. Every day your money is in the market is a day that it can potentially be working towards make you a millionaire.