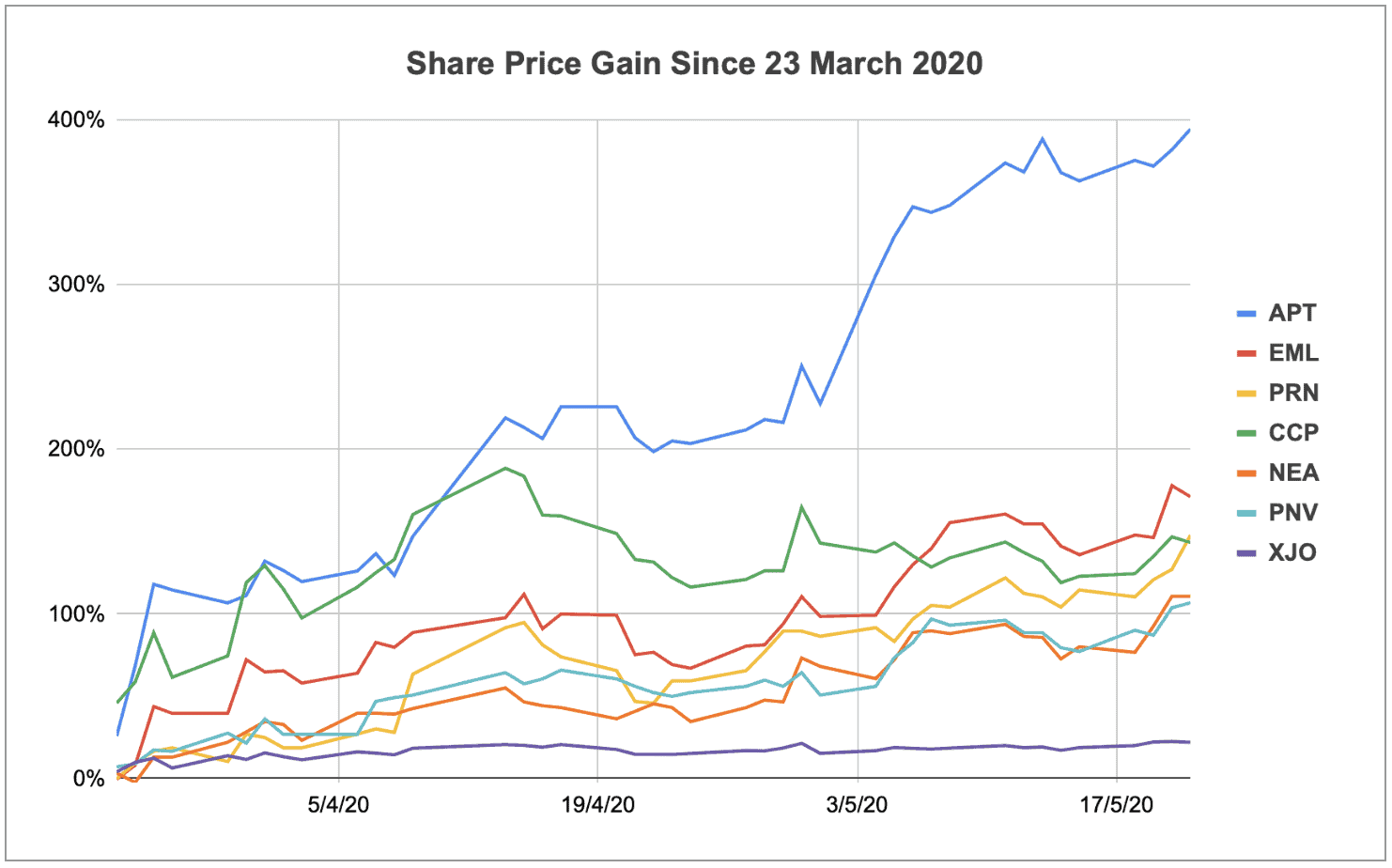

We're almost 2 months on from the fastest bear market on record, which saw the S&P/ASX 200 Index (ASX: XJO) fall 36.53% from 7,162.50 points on 20 February to a low of just 4,546 on 23 March.

In the time since, however, the market has rallied on the back of unprecedented fiscal support, a flattening COVID-19 curve, and perhaps a whole lot of optimism. So much so that a number of ASX 200 shares heavily sold-off in the downturn have bounced back with a vengeance.

With this in mind, here are all the ASX 200 shares that have doubled or more in price from 23 March through to yesterday's close:

Afterpay Ltd (ASX: APT) — 394.38%

It's been an eventful couple of months for the Afterpay share price. The buy now, pay later provider's recent rollercoaster ride on the ASX has certainly been a hot topic, falling to a low of $8.01 in March due to COVID-19 concerns. The thinking was that with the economy in hibernation and unemployment becoming a real issue, Afterpay's bad debts were at risk of blowing out, all the while customers would have less of an appetite to spend.

But 2 months, a flattening curve, and a JobKeeper package later, the Afterpay share price is reaching new heights. Just yesterday, Afterpay shares hit an all-time high of $45.17, buoyed by the company's announcement of reaching 5 million active US customers.

Since the bottom of the bear market in March, the Afterpay share price has also been boosted by a positive trading update and news of Chinese tech giant Tencent becoming a substantial shareholder.

EML Payments Ltd (ASX: EML) — 171.16%

The EML share price experienced a significant fall from grace in the recent bear market, plunging from its February high of $5.70 to close on 23 March at just $1.34.

Whilst the broader market has been on an upward trend ever since, it's EML's renegotiated acquisition terms that have gotten investors particularly enthused. In late March, the company announced more favourable contract terms for its acquisition of Prepaid Financial Services, a leading provider of white-label payments and banking-as-a-service technology across the UK and Europe.

What's more, earlier this week, EML released a trading update, quantifying the effects of COVID-19 on March and April performance and remaining upbeat about achieving a solid full-year result in FY20.

Perenti Global Ltd (ASX: PRN) — 147.92%

The mining services group has been on a tear recently, notching up a number of impressive one-day gains at times when there was seemingly no news out of the company.

Perenti first delivered a trading update on 24 March, disclosing that COVID-19 hadn't yet had an impact on its financial performance. Nonetheless, it decided to withdraw FY20 earnings guidance for safe measure. The following day, the company deferred its interim dividend and outlined a range of capital management initiatives to ensure financial strength throughout the crisis.

On 15 April, Perenti confirmed it still hadn't experienced any material financial impact from the pandemic. On the whole, it appears investors deemed this mining services share heavily oversold, flooding back to the company in droves.

Credit Corp Group Limited (ASX: CCP) — 143.36%

Being Australia's largest debt buyer and collector, Credit Corp shares naturally took a beating as soon as the market started taking a turn for the worse. In fact, the Credit Corp share price spiralled from an all-time high of $37.99 in February to just $6.25 on 23 March – an 84% drop.

In the period since, Credit Corp made the move to withdraw its FY20 earnings guidance and completed a $120 million institutional placement to strengthen its balance sheet and pursue debt purchasing opportunities. In any case, as one of the hardest-hit companies in the bear market, investors saw value in the Credit Corp share price after the government announced a series of financial support measures. However, most of Credit Corp's recent gains have come in late March and early April, with shares actually down 15.64% since 14 April.

Nearmap Ltd (ASX: NEA) — 110.80%

Those following along with Nearmap's journey might remember a fateful day in late January this year when the company downgraded FY20 guidance, causing shares to plummet 30%. Well, despite COVID-19 concerns, the Nearmap share price is actually now trading higher than these January lows after more than doubling since the bottom of the bear market.

Along with overall market sentiment, shares in the aerial imagery and location data company have been spurred on by a business update released in April. At the time, Nearmap revealed trading conditions had not been materially impacted by COVID-19, brushed off concerns over the need to raise additional capital, and announced its intention of reaching cash flow breakeven by the end of FY20.

PolyNovo Ltd (ASX: PNV) — 106.82%

Last but not least we have PolyNovo, the up-and-coming healthcare star that announced its arrival on the ASX 200 stage last year by posting a 231% annual gain.

After succumbing to a near 60% fall in the recent bear market, investors have been clamouring to get their hands on PolyNovo shares following a positive trading update released in early April. The company announced a record monthly sales result for the US in March and didn't believe the coronavirus would have a material impact on its business.

Foolish takeaway

The seemingly never-ending sea of red we saw in the markets earlier this year was, understandably, a difficult pill to swallow for many investors. However, these gains just go to show the kinds of opportunities that can arise in a bear market.

Learning to master your emotions and capitalise on depressed valuations in times like this can go a long way in fast-tracking your journey to long-term wealth creation.