Up to 800,000 Australians have lost their jobs in the wake of the coronavirus pandemic and associated restrictions. The latest data from the ABS shows a steep decline in jobs and wages since shutdowns and social distancing measures were introduced. Jobs have fallen by 6% and wages are down 6.7% since Australia reported its 100th COVID-19 case.

Steep fall in jobs and wages

The latest ABS data shows employee jobs decreased 6% between the weeks of 14 March and 4 April. Over the same period, total wages paid declined by 6.7%.

The fall was steepest in the week ending 4 April, when employee jobs decreased by 5.5% (a 0.5% decrease was recorded the previous week). Total wages fell by 5.1% in the week ending 4 April (compared to a 1.3% fall the previous week).

Unemployment rate

The unemployment rate remained steady in March at 5.2%, however, the reference period only covered 1 March to 14 March. This means unemployment data doesn't include the period after a global pandemic was declared and major actions were taken in Australia to contain the spread of the virus.

According to March unemployment data, some 13 million Australian were employed in mid-March. When the decline in employee jobs is factored in, it appears that up to 800,000 Australians could have lost jobs in the second half of March and start of April. The bulk of job losses came in the last week of March and start of April.

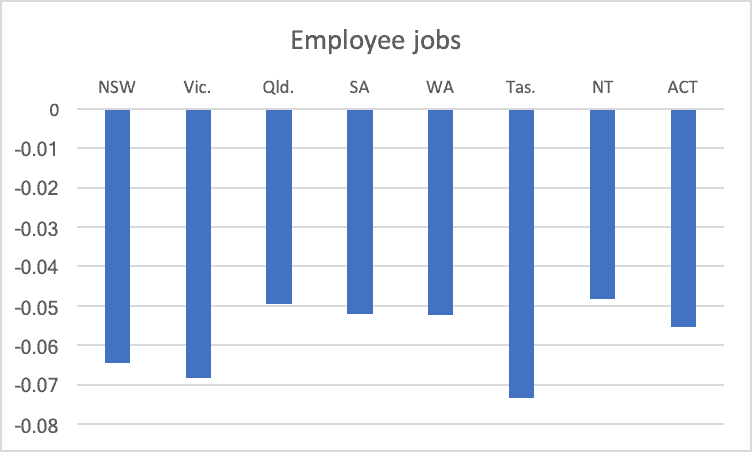

Nationwide hit

Job losses have occurred across the nation with all states impacted. Tasmania and Victoria have been hardest hit with jobs down by 7.3% in Tasmania and 6.8% in Victoria. Queensland and the Australian Capital Territory have fared better, with losses of 5% and 5.5% respectively.

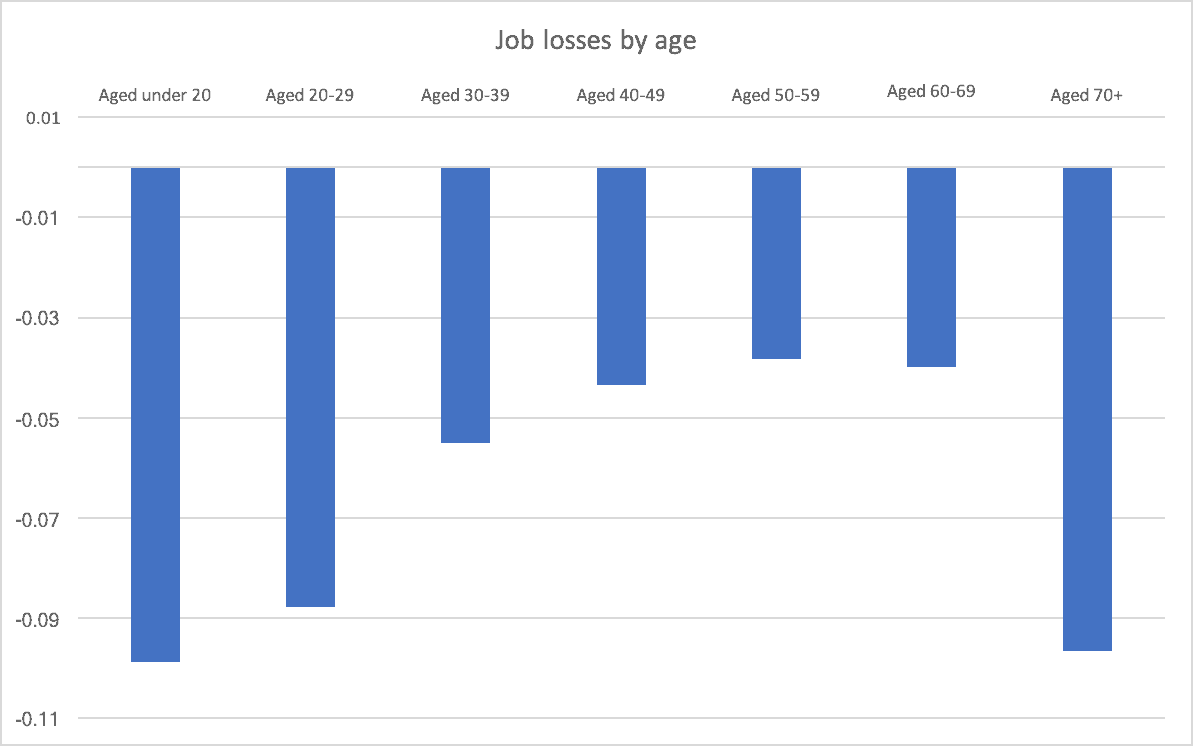

Australia's oldest and youngest workers have been most impacted by job losses, with a decline in employee jobs of 9.9% for those aged under 20 between 14 March and 4 April. Those aged 70 years and over saw a 9.7% drop in jobs.

Hard hit industries

The reduction in jobs was widespread, with all industries seeing declines. Some industries, however, have suffered more than others. In accommodation and food services, jobs declined 25.6% between 14 March and 4 April, while wages were down 30.1%. Arts and recreations services have also been hit hard, with jobs down 18.7% and wages down 15.7%.

Those working in education and training fared the best, with jobs declining only 0.1% between 14 March and 4 April, although wages fell 0.7%. Electricity, gas, water, and waste services also fared well with jobs falling only 1.1% and wages declining 1.9%.

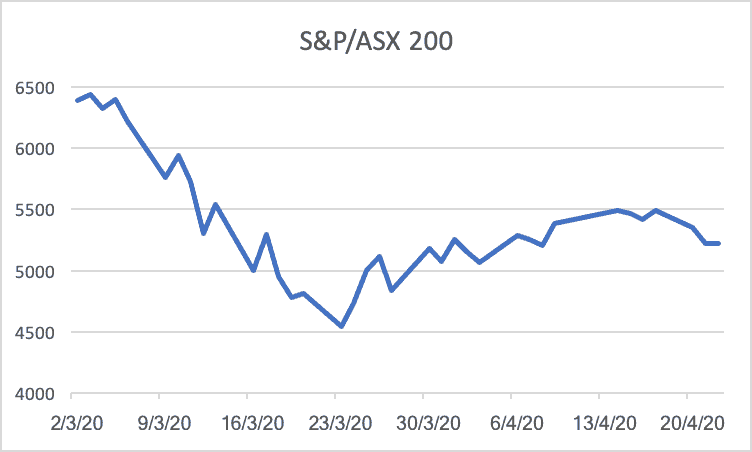

Share market climbs

Over the same period when 800,000 Australians lost their jobs, the S&P/ASX 200 Index (ASX: XJO) first fell, and then rose. Between 14 March and its low on 23 March, the S&P/ASX 200 fell 18%. It then climbed 11.5% between its 23 March low and 4 April.

The ASX 200 has continued to climb in the interim, reaching a peak of 5,487.50 last Friday, before retreating this week. Investors now appear to be beginning to factor in the long term impacts of the pandemic, including unemployment.