It's a tough time on the Australian share market, no way around it. Since mid-February, the S&P/ASX 200 Index (ASX: XJO) has lost over 30% of its value.

Many investors would have sold their shares during this time, but as the great Warren Buffett has told us, there are always times during economic storms when it rains gold – in the form of good quality companies on sale.

Therefore, it's safe to say the smart investors out there will have been net buyers during this bear market, just as Mr Buffett would be inevitably practising what he preaches.

No one knows when the market will bottom, but if shares are on sale, it still makes sense to be deploying money if your financial situation allows it, in my view.

So here are 5 ASX shares that I think smart investors would be buying right now:

Woolworths Group Ltd (ASX: WOW)

It makes no sense to me that the Woolworths share price has fallen around 15% since the start of the crash.

This supermarket giant is probably experiencing one of its biggest increases in sales outside the Christmas period in history. And what's more, interest rates are now at 0.25%, compared to the 0.75% we had before this crash started.

Remember, Woolworths Group doesn't only own the Woolworths supermarket chain. It also owns some of the biggest bottle-shop chains in the country, including Dan Murphy's and BWS – all shops that have also seen a massive increase in sales during this time.

These would be offsetting Woolworths' other businesses like Big W and its hotels portfolio right now, which are subject to closures and restrictions.

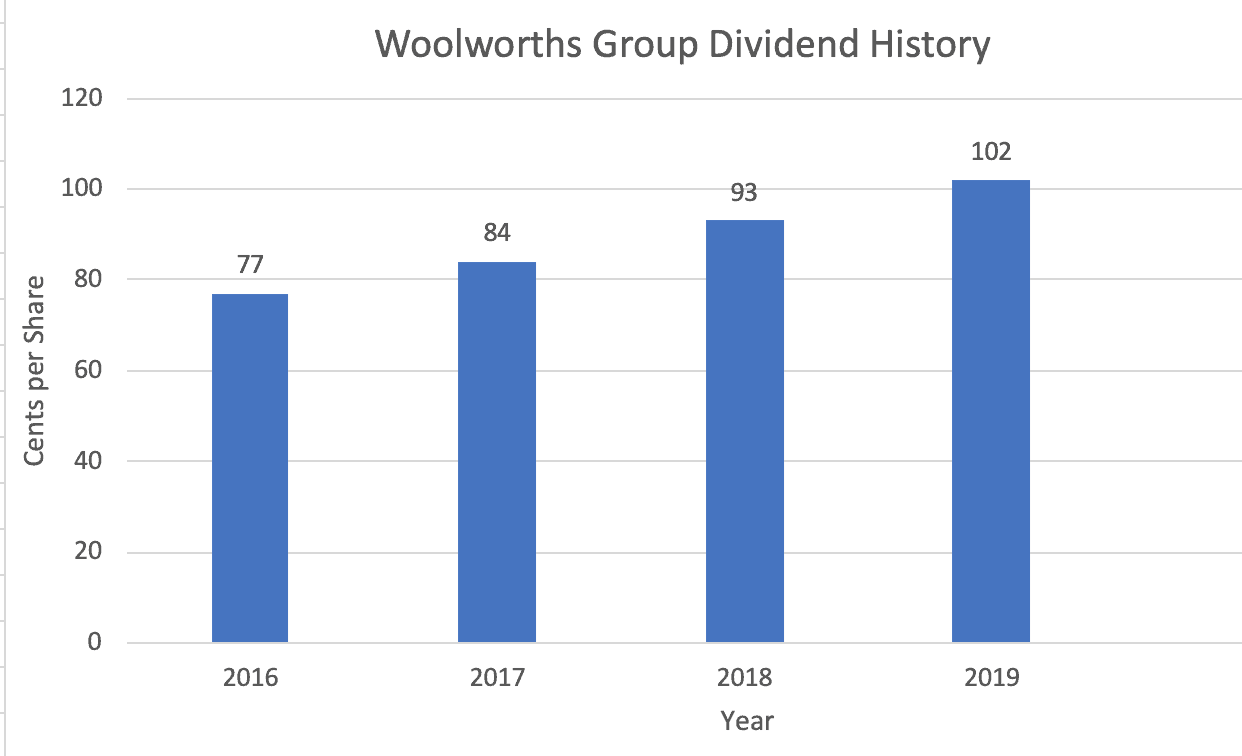

Still, the company's current share price tells me that Woolworths shares are on sale right now and smart investors would know this. On current prices, Woolworths is offering a grossed-up dividend yield of 4% after strongly increasing its payouts over the past 4 years:

As a defensive dividend-payer with a strong earnings base in a recession-resistant industry, I think Woolworths is one of the safest blue-chip bets on the ASX during this time and in my opinion, the smart money knows it.

Telstra Corporation Ltd (ASX: TLS)

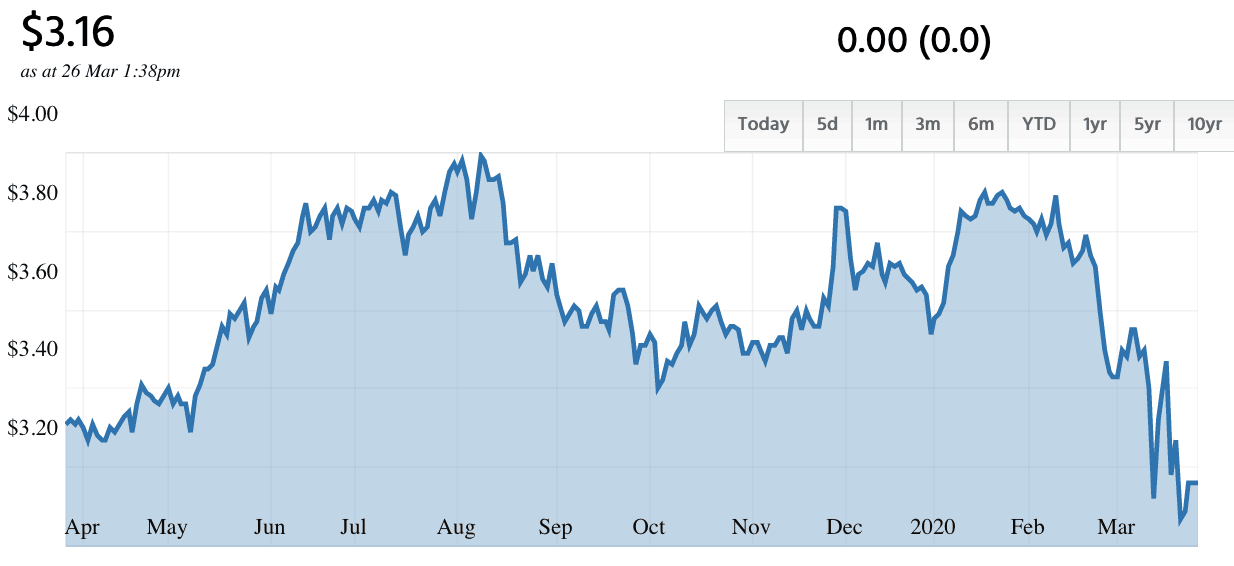

Telstra is another defensive blue-chip that has been sold off over the last few weeks, but again, I see a compelling buying opportunity here.

Since mid-February, the Telstra share price has fallen around 19% and is now a long way from the company's 52-week high of $4.01 – as you can see from the chart below!

That's why I see a 'smart' opportunity with this ASX telco giant.

Telstra makes money by selling phones, data plans and access to fixed-line internet. As the country is now in coronavirus lockdown and most people are staying at or working from home, internet use is only going to climb.

That means people keeping their current Telstra internet plans or even upgrading for more data allowances. For this reason, I see Telstra's earnings at least keeping steady during this time, with even the possibility of a bump.

On current prices, Telstra shares are offering a trailing dividend yield (including the NBN special dividends) of 5.06%, or 7.23% grossed-up with full franking.

Again, in this era of zero interest rates, this looks to me like a very smart deal for ASX dividend investors today.

Sydney Airport Holdings Pty Ltd (ASX: SYD)

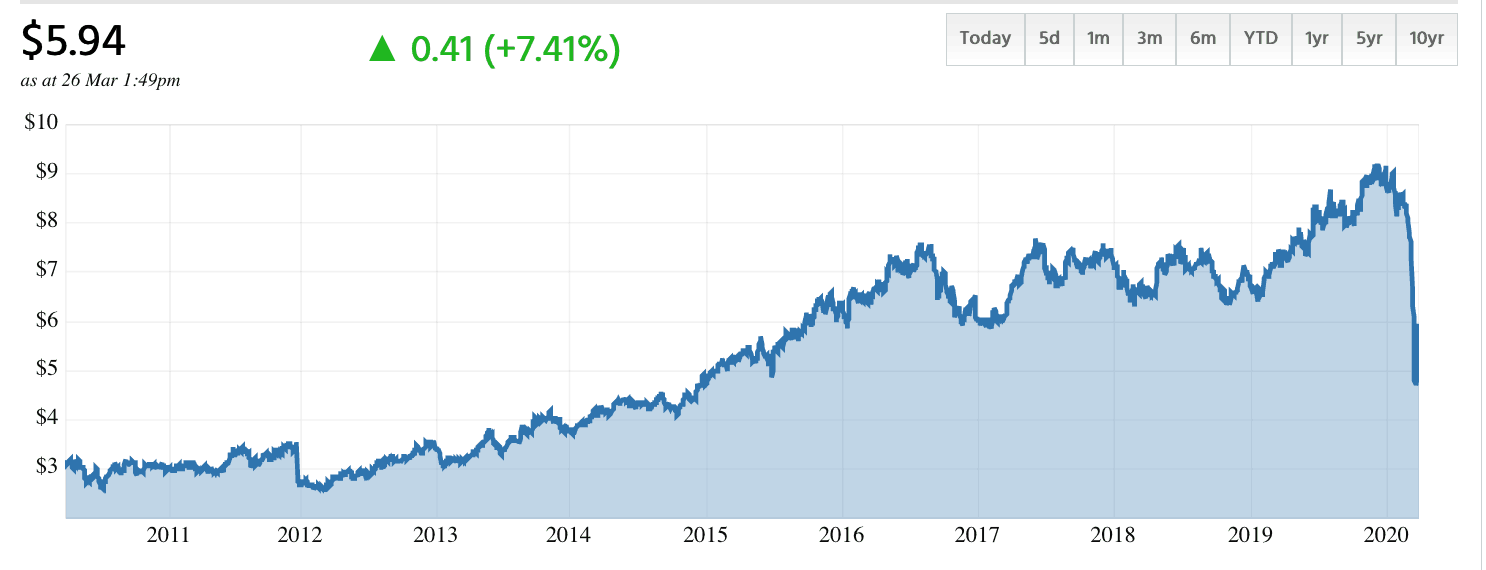

Sydney Airport used to be considered one of those ultra-safe, bond proxy ASX dividend shares – until the travel industry went into the deep freeze.

Since the start of the ASX 200 crash, the Sydney Airport share price has lost around 37.5% of its value after almost a decade of steady climbing:

But that has pushed Sydney Airport's trailing dividend yield to its highest level in years at around 6.72% (at the time of writing).

Now, I think it's worth mentioning that the earnings prospects of this company are fairly bleak for at least this year.

Since Australians are now banned from travelling for most intents and purposes, I would expect this company's revenues for the remainder of the year to take a massive hit.

But once the coronavirus crisis passes, I don't see any reason why it won't be a return to 'business as usual' for Sydney Airport – even if it takes more than a year.

Sydney Airport has a virtual monopoly on NSW air travel, after all. For smart investors with a long-term investing horizon, that should be music to the ear.

Afterpay Ltd (ASX: APT)

Afterpay has had an almost comical reputation on the ASX over the last week. We have seen some of the most extreme volatility on the entire stock market take place with this one stock.

Just take a look at the Afterpay share price below over the past month!

Yes, Afterpay does have a 52-week high of $41.14 and a 52-week low of $8.01. And you can guess which side of this range Afterpay is closer to right now.

This is probably the most speculative 'smart' stock that's on this list today. But clearly, someone's been buying in recent days, and I happen to think it's 'smart money'.

Yes, Afterpay will probably take a short term hit in transaction volumes from retail stores. But I still think there will be plenty of bored millennials that will be wiling the hours at home away with some good old fashioned online shopping.

This is a company that invented a 'new way to pay' for millions of customers all over the world. And not only that, it has kept its first-mover advantage well and truly intact as rivals like Zip Co Ltd (ASX: Z1P) have emerged.

Remember, it was only last month that Afterpay reported a 109% increase in sales volumes for the half-year ending December 2019.

I don't think this is a company going anywhere, and with a stock price that's tanked 58% since mid-February, I think Afterpay is a very smart buy today.

Collins Foods Ltd (ASX: CKF)

Our final 'smart investor' stock today is Collins Foods – the Australian operator of the world-famous Kentucky Fried Chicken (KFC) fast-food chain.

The Collins Foods share price was smashed earlier this month when the company reported one of its workers in Queensland tested positive for COVID-19 – shuttering the restaurant in question. The company's shares have now lost 45% of their value since mid-February (at the time of writing).

But again, I don't see the long-term fundamentals for this business changing at all as a result of this crash.

KFC restaurants may be closed for in-house dining across the country, but KFC already has a widely-used drive-through network in place that will continue to serve its loyal customers.

Fast food is a comfort food above anything else, and so I see customers continuing to visit 'the Colonel' throughout this shutdown, perhaps in even greater numbers.

For this reason, I think Collins Foods is a company smart investors would be buying right now.

Foolish takeaway

Smart investors will be following Warren Buffett's lead and buying shares at historically low prices right now.

These 5 ASX shares fall firmly into the category of 'smart buys' in the current share market environment today, in my opinion.

Yes, many of them would be experiencing some short-term headwinds from the coronavirus shutdown right now.

But I think all 5 companies are strong enough to weather this storm and come out the other side stronger than ever.