One of the hardest things in the journey of investing is actually pulling the trigger on your first shares.

There will always be one reason to invest in shares (to build long-term wealth) and a thousand reasons why people will tell you that now's not the right time (Brexit, inverted yield curves, stock market at all-time highs, etc).

I'm all for making prudent, price-sensitive decisions on when to invest in your favourite shares. No one wants to catch what turns out to be the peak of a company's share price, after all.

But the longer you delay investing at all, the more potential returns you're giving up.

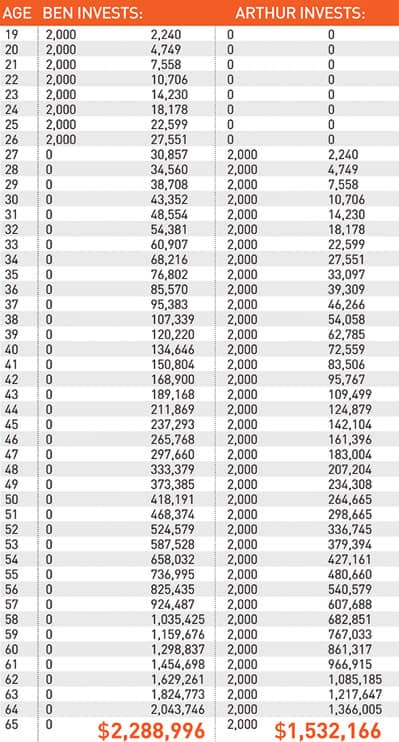

Just take a look at this example, provided by daveramsey.com, which assumes an interest rate of 12% per annum.

Source: daveramsey.com

In this scenario, you can see the massive benefits of additional years of investing. The first teenager 'Ben' doesn't even invest after the age of 26, yet still ends up with more money at age 65 than the other teen 'Arthur', who didn't start investing until the age of 26, but dutifully invests every year until 65. Even though Arthur invests $62,000 more of his own money than Ben, it's the time in the market that really counts.

Now it's worth pointing out that the stock market doesn't give you a consistent rate of return like a term deposit does. In fact, the average performance of an S&P/ASX 200 (INDEXASX: XJO) index fund has traditionally come in around 8–10% per annum on average over a long period of time.

That means that some years we see gains of 22%, like we saw in 2019, and occasionally we see losses of ~50% like we saw in 2008 (although that was a particularly brutal year). The important thing to note is that shares usually end up growing your wealth over the long-term.

None of us know when the next crash is coming – or indeed the next boom. I don't think anyone was predicting last year would be such a bumper year for stocks. But here we are.

Foolish takeaway

I think it's best to start investing as soon as possible, stay invested, keep a little cash on the sides if you must and ride the rollercoaster with the rest of us.

And the earlier you get started, the better. So if you haven't already taken that first step on your investing journey, don't worry about the other 997 reasons not to invest and just bite the bullet!