Japara Healthcare Ltd (ASX: JHC) is one of Australia's largest providers and developers of residential aged care – a sector we have all been tirelessly told will experience rapid growth.

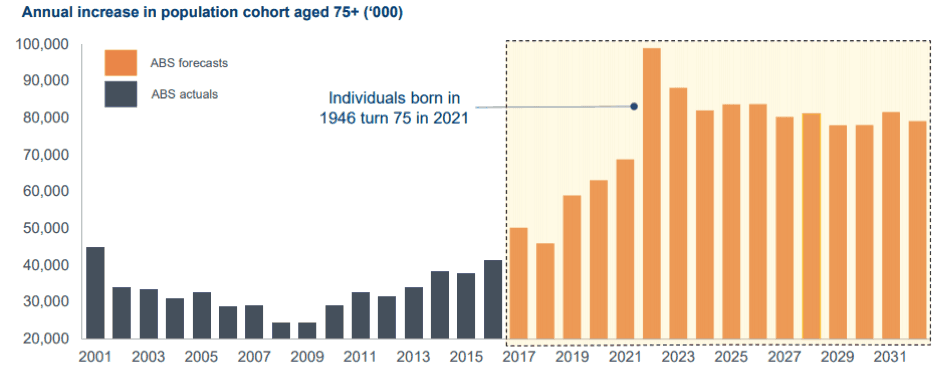

This is a fact which is substantiated by the below graphic, showing the forecasted increase in population over 75 (you can really see when WWII ended!).

Source: Japara 2019 AGM – CEO's Presentation

So, with such a strong tailwind, why has the Japara Healthcare share price been a poor performer over the past few years, dropping from a high of $3.45 in 2015 to trade at $1 today?

Japara's FY19 performance

Japara's 2019 results provided a mixed bag. Total revenue was up 7.1% on FY18, mainly due to a full-year contribution of its Riviera Health acquisition. This contrasted with a 29.6% decrease in net profit after tax (NPAT), owing to lower non-recurring earnings and increasing depreciation and interest expenses.

Additionally, it has been a tough year for Japara due to the aged care royal commission, low funding increases from the government and wage growth in the industry. Japara has also reported that occupancy levels are also below historic trends, sitting at 93% compared to 93.2% in FY18 and 94.6% in FY17, which indicates a steady decline.

Dividends

Total dividends have also been decreasing, with a dividend of 6.15 cents per share (cps) paid in FY19 compared to the 7.75 cps paid out in FY18 and 11.25cps in FY17. Japara has a stated policy of paying a full year dividend of up to 100% of its NPAT. Interestingly, its dividend payout for the recent year was 100% compared to only 88% last year, meaning unless it can increase its NPAT in 2020 we would expect to see another reduction in its dividend for FY20.

Debt and developments

Japara reported total net debt of $179 million, which was up from $116.3 million on the prior year due to its $99.4 million expenditure in its growth pipeline on land acquisitions and construction. This increase in debt consequently saw an increase in interest expenses, which partly accounts for its sharp decrease in NPAT.

FY19 saw the completion and opening of 3 greenfield developments and extensions at existing sites giving rise to 303 new places added. Additionally, 6 homes were also significantly refurbished with another 6 to be completed in FY20.

Foolish takeaway

Japara maintains 100% accreditation across its portfolio and, despite the company's NPAT being down over the past few years, I believe it could pay to take a contrarian view.

Considering Japara's share price has been beaten down by the market, now could be a great time to buy given the long-term tailwinds and its heavy investment in growth to meet these demands. However, this comes with the risk of trying to catch a falling knife too early and it may be prudent to wait until 28 February when the company releases its FY20 first-half results to see if there is any improvement.`