One of the most defining themes of 2019, in my opinion, has been the solidification of record low interest rates by the Reserve Bank of Australia (RBA). The official cash rate was at 1.5% this time last year. But a triple-dose of interest rate cuts in 2019 leaves us with an interest rate of just 0.75% as we enter the new decade.

Interest rates have never been so low and most market commentators are predicting at least one more cut in 2020. An Australian Quantitative Easing (QE) program has even been floated as a possibility by the RBA.

The three interest rate cuts we've seen this year have likely been a big contributor to the last twelve months of bumper gains that the ASX markets like the S&P/ASX 200 (INDEXASX: XJO) have enjoyed. Lower interest rates increase the attractiveness of ASX shares (particularly of the dividend-paying variety) in comparison with other 'less-risky' assets like government bonds and cash savings.

Why I'm watching interest rates in 2020

So it looks like the interest rate environment has already been mapped out for us next year. But here's why I'm watching the RBA and interest rates like a hawk in 2020. If inflation ticks up and/or interest rates start to rise again, alarm bells will be ringing in my ears. Markets are currently pricing in lower interest rates and if this were to change, I would expect a violent stock market correction – both here on the ASX and over in the US.

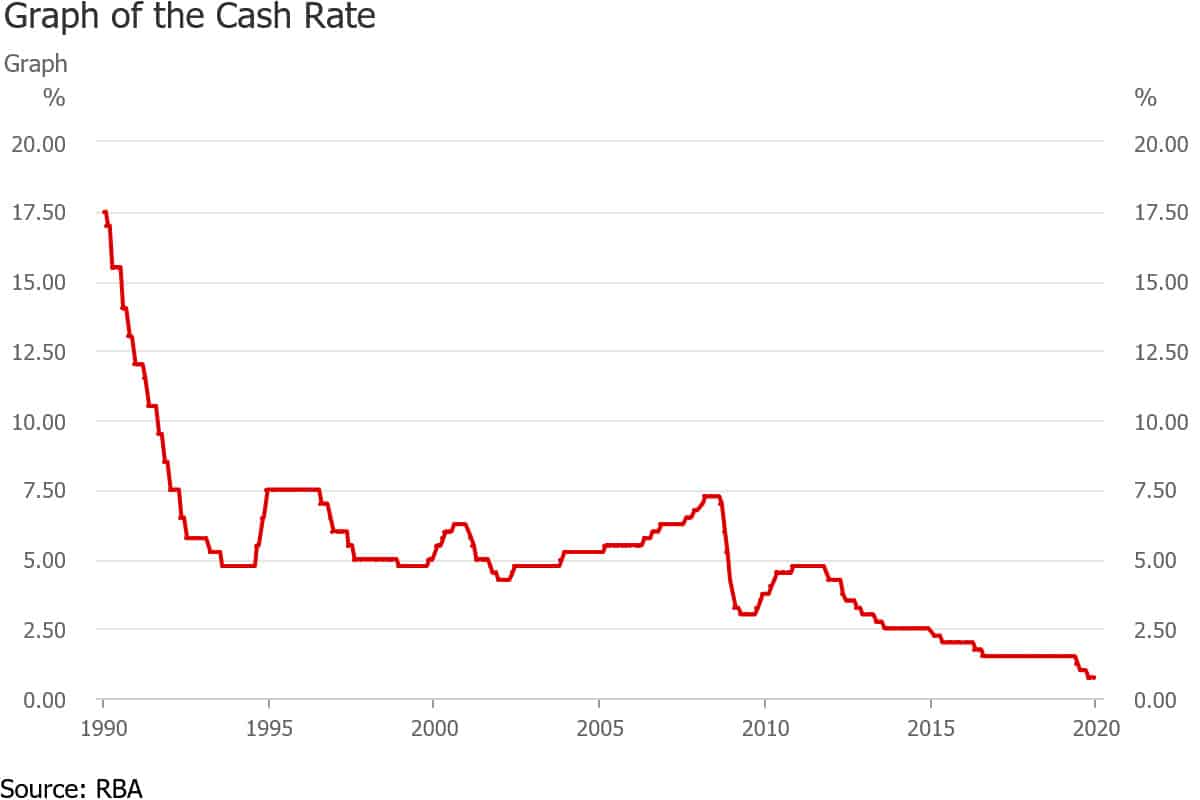

If we look to history, rising interest rates are almost always followed by an economic recession and stock market crash. Just take a look at this graph from the RBA.

As you can see, the last two stock market crashes (the 2000 tech bubble and the 2008 GFC) were preceded by a pattern of rising interest rates. Thus, any sign out of the RBA or the US Fed that might indicate a… hawkish pivot in monetary policy should make your ears prick up.

Foolish Takeaway

Trying to time the market on these kinds of things is foolish (of the lower case 'f' variety), but I still think it pays to look at the lessons of history and adjust the risk tolerance of your portfolio accordingly. That's why I'm watching the RBA and the Fed like a hawk and why I think all investors should as well.