Well, the S&P/ASX200 (INDEXASX: XJO) is having a shocker – falling another 1.75% at the time of writing to 6,594 points. That puts its total losses for the week so far at around 4.25% (and it's only Wednesday).

You might have seen some dramatic headlines like '$50 billion wiped from ASX in day of carnage' or 'share market in sea of red' – so we should all sell up and run for the hills, right?

Not so fast.

Headlines about the stock market falling are always shriller and more sensationalist than those reporting gains (which is what happens most of the time anyway). I like to think of days like today as opportunities, rather than 'days of carnage'.

Yes, the US–China trade war has taken a negative turn, but this has happened half a dozen times this year already, and markets have still pushed higher regardless.

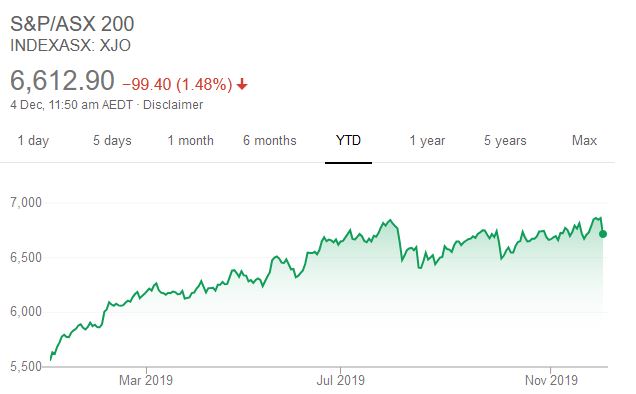

Take a look at this graph of the ASX 200 over the course of the year.

Source: Google Finance

That's right, this week's 'carnage' is that little dip on the end. The ASX still doing exceptionally well in 2019 and really has delivered a bumper year of dividends and growth to investors across the board.

Here's what I see when I look at the markets today:

Westpac Banking Corp (ASX: WBC) down another 1.36% to $23.96 a share. Yes, this ASX bank has a lot of work to do to restore confidence in its management and operations. But today, you can pick up WBC shares with a starting yield of 6.68% (9.54% grossed-up). And that yield takes into account the dividend cut Westpac recently announced.

The 'new' Afterpay Limited (ASX: APT) is down a whopping 4.63% today as well. What a great time to pick up APT shares if you've had this one on your watchlist!

BHP Group Ltd (ASX: BHP) is also looking cheap at $36.62 – down over 3%.

Foolish takeaway

It's not hard to find a stock on sale today. So if you've got some cash sitting on the sidelines, why not take advantage of what the markets are offering – it's not carnage, it's a late Cyber Monday sale!