Why do people invest in bonds?

For most people, I'd wager that 'bonds' are something often heard, but not really understood well, let alone invested in. In comparison to shares – specifically those Aussie shares that trade on the ASX – bonds don't enjoy nearly as wide of an interest amongst the Aussie investing community.

But head across the Pacific to the United States and bonds are often viewed with as much interest as shares. The standard US 'balanced' investing portfolio is known as the '60/40' – that's 60% stocks and 40% bonds. I've even had some of my American friends tell me that they often received a US Treasury Bill as a birthday gift when they were younger, often from their grandparents. I don't recall any Australian ever telling me a similar story.

So are us Aussies missing out on the 'bond thing'? And what kind of role can bonds play in an investing portfolio? Those are some of the questions we'll be looking at today.

What are bonds?

Despite the fancy name, a bond is essentially a debt instrument or more simply – a loan. The nearest comparison that comes to mind is an interest-only mortgage – which consists of a principal lump sum amount lent to the borrower that is repaid at maturity (the maturity date is agreed on before the loan is issued). This is, of course, combined with regular interest payments to the creditor, which are at fixed intervals.

With a bond, some of the terminology is different, but the principle remains the same. The interest rate is called a 'yield' and the interest payments are known as coupons. Because of this nature, bonds are sometimes called 'fixed-interest investments'.

Although bonds are issued on what's known as a primary market (from issuer to creditor), the bonds can then subsequently trade on a 'secondary market' (a bond market) in a similar fashion to shares. As the owner of the bond is entitled to receive the principal back at the bond's conclusion, its price can fluctuate in the meantime depending on market conditions.

Bonds can technically be issued by anyone, but there are 2 common types that investors are interested in: government bonds and corporate bonds.

Government bonds are issued by…. governments (no points for guessing that one) in order to fund public spending. If a government's budget is running in deficit, this is usually what is used to fund any spending shortfalls. Government bonds are usually associated with limited or no risk, as a government has the power to print more money to fund the bond repayments (as the US government has been doing for many years now). Common government bonds come in 1-year, 5-years and 10-year durations. Over in the US, you can even get a 30-year Treasury bond.

Corporate bonds, on the other hand, are issued by companies, public or private. There is a higher level of risk associated with corporate bonds as (unlike governments) companies can go bankrupt and default on their debt. If this occurs, it's very unlikely that the bond's principal can be recovered.

Due to the varying levels of risk associated with bonds, the market normally demands an interest rate appropriate to the said level of risk. Thus, government bonds usually trade with lower yields than corporate bonds. Highly risky companies (such as those not profitable) will sometimes issue 'junk bonds', which reflect this level of risk that its creditors are undertaking. These bonds usually carry the highest yields on the bond market.

Why do people invest in bonds?

Because bonds are a different asset class to stocks, they can perform different functions within a portfolio. Stocks, although historically more lucrative than bonds, are also far more volatile as an asset class. During times of market volatility, investors often flock to bonds as a safe haven – hence bonds are usually classed as a 'defensive' portfolio asset.

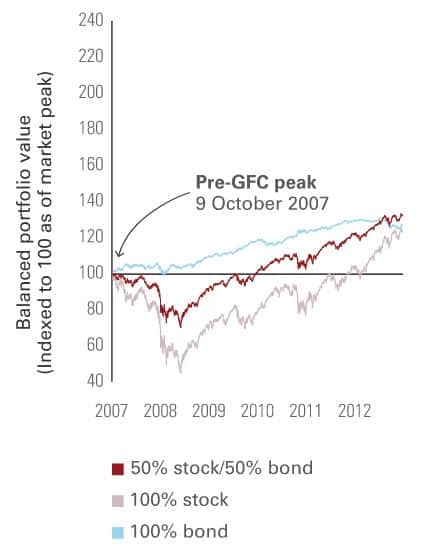

In the graph below, you can see the performance of 3 portfolios during and after the GFC. One is a complete stock portfolio, one is a 'balanced portfolio containing stocks and bonds, and one is a total bond portfolio.

Source: Vanguard Australia

As you can (hopefully) see, bonds handsomely outperformed stocks from 2007 all the way until 2012 – thus you can see the American appeal of a 60/40 portfolio to a more conservative investor.

How can you buy bonds in Australia?

Although we Aussies don't have the same affinity for bonds as our American friends, fixed-interest investments are still available for all investors through exchange traded funds (ETFs). Bond ETFs work by holding a basket of bonds within a fund, which any investor can buy shares or 'units' of.

If you just wanted to stick with government bonds, then iShares Treasury ETF (ASX: IGB) might be a good choice. IGB holds bonds issued solely by either the federal government or state governments. Buying units of this ETF will give you direct exposure to the price movements and yields of the Australian government bond market.

Alternatively, the Vanguard Australian Fixed Interest Index ETF (ASX: VAF) is a mixed fund comprised both of Commonwealth and State government bonds and 'investment grade' corporate bonds. This fund would be more suited to an investor looking for a slightly higher risk/reward ratio. There are many more ETFs or managed funds that deal exclusively with bonds, so if you're looking to research this area further, there's a lot of options out there.

Should you buy bonds for your own portfolio?

With the markets at record highs, conventional risk management would dictate a 'rotation' into defensive assets like bonds would be prudent.

However, our record low interest rates have the effect of lowering the yield our governments and companies can give out to bond holders. For example, the current (at the time of writing) Australian Government 10-year bond coupon rate is a miserly 1.19% per annum. That means anyone purchasing a 10-year bond today is locking in a return of 1.19% for the next decade.

This means that the traditional ability of bonds to 'balance out' stocks in a portfolio has a lot less firepower that you would have got 5 or 10 years ago, at least from a yield perspective.

Foolish takeaway

I think bonds do still have a role to play in a conservative investor's portfolio today. We are in uncharted territory when it comes to monetary policy and interest rates – not just in Australia but around the world.

Therefore, I think having a portfolio diversified across many different asset types is the best way to fortify your wealth.