Nearmap Ltd (ASX: NEA) shares climbed 10% to $2.74 this morning after the aerial mapping business told investors to expect annualised contract value (ACV) between $116 million to $120 million in fiscal 2020. That would equal growth around 29% to 33% over the $90.2 million in ACV posted over fiscal 2019.

At its AGM today the company declined to provide any more specific financial guidance, although $120 million in ACV, if delivered, would be another strong year for the software-as-a-service (SaaS) player.

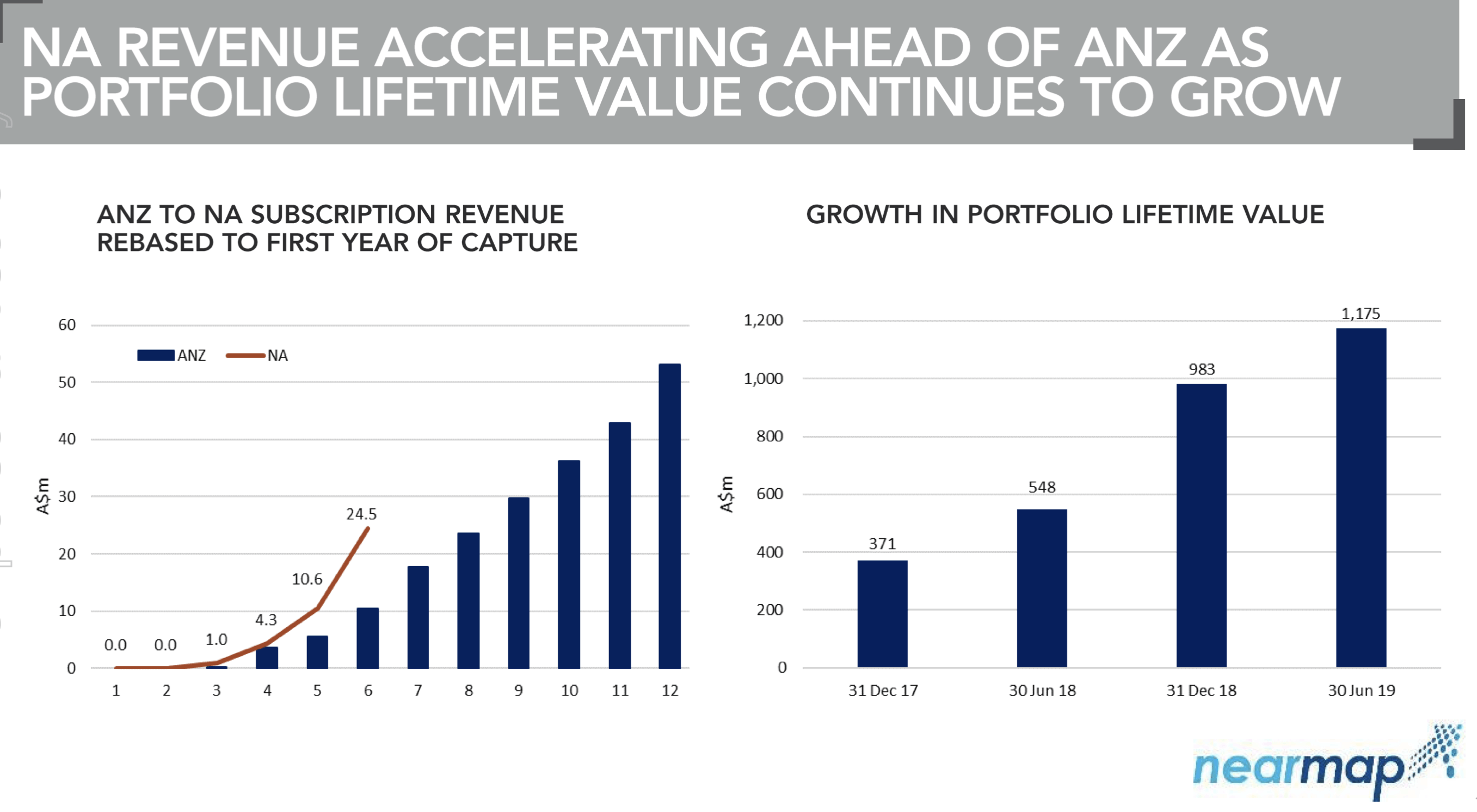

For investors the large U.S market remains the key growth opportunity and the chart below shows how Nearmap has progressed in this market over the last 6 years compared to Australia.

Source: Nearmap presentation November 14, 2019.

Evidently if Nearmap's growth in the U.S. market continues to accelerate it could be a highly profitable business in a couple of years' time. This is no secret though with it already boasting a market cap around $1.24 billion based on 450.9 million shares on issue.

Around 9% of Nearmap's scrip is currently shorted according to the latest ASIC data with today's ACV forecast putting the heat on short sellers betting against the business. Some of today's share price rises may be the result of short sellers scrambling to buy back shares and close out positions.

Nearmap's Australian business is already profitable on a standalone basis and the group sports the high gross profit margins that are the calling card of popular cloud-based SaaS businesses.

This means the group has plenty of room to invest in sales, marketing, and product development that should generate more top line growth.

For now the investments are dragging the group into the red, with its full year result for fiscal 202o likely to be around breakeven.

Other popular SaaS businesses on the S&P/ ASX200 (ASX: XJO) include Xero Limited (ASX: XRO) and WiseTech Global Ltd (ASX: WTC).