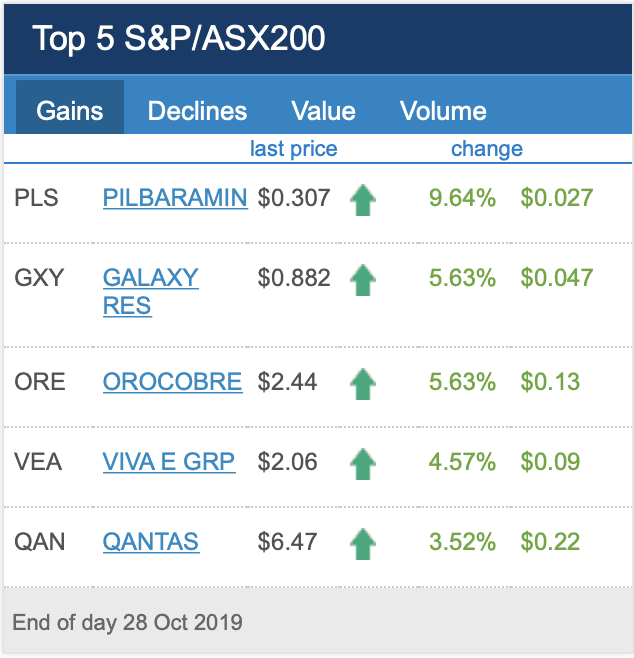

It's been a tough run for investors in the ASX's leading lithium stocks, but a strong start to this week at least. In fact the market's best lithium stocks dominated the S&P/ ASX200 leaderboard today.

Source: ASX October 29, 2019.

We can see that Pilbara Minerals Ltd (ASX: PLS), Galaxy Resources (ASX: GXY) and Orocobre Ltd (ASX: PRE) are today's winners.

One key risk investing in lithium miners is that there's no spot or exchange traded futures market for physical or synthetic lithium prices.

This means the miners' stock prices are volatile as investors can be left in the dark.

Moreover, it means the miners themselves are taking on more risk as it's hard to assess capex commitments for development given the lack of futures pricing. So without over-the-counter style forward or off-take contracts the miners are taking on a lot of risk.

However, it seems the strong quarterly result from battery powered electric vehicle giant Tesla has boosted sentiment in the lithium sector.

Tesla has forecast strong demand for its vehicles, while other car companies are also ramping up their investments in the electric vehicle future.

As such it seems bargain hunting investors are betting on lithium prices rebounding through 2020.