The WAM Research Limited (ASX: WAX) has been on a tear over the past month, rising from $1.29 in mid-August to today's price (at the time of writing) of $1.44 – a jump of nearly 12%.

Despite this run, WAX shares are still offering a starting yield of 6.92% today – which rises to 9.85% if you include the value of full franking credits. This massive yield – over 4 times what you could expect from a term deposit these days – is even bigger than Westpac Banking Corp (ASX: WBC)'s famous dividend and bigger than all four of the ASX major banks in fact.

So, is WAX worth an investment for this yield, or is this return way too big to be sustainable?

Who is WAM Research?

WAM Research is one of the listed investment companies (LICs) run by Wilson Asset Management – a group renowned for their successful investment strategies and high-yielding funds. WAM Research focuses on pricing opportunities in small- to medium-sized ASX companies, typically outside the ASX 100.

It has been able to do so very effectively too, boasting a annualised average return of 16.4% since 2010. This solid history has led to WAX shares being habitually priced at a premium to the company's net tangible assets (NTA), which today is asking $1.44 for every $1.20 worth of assets.

Is WAM Research a buy for the dividend?

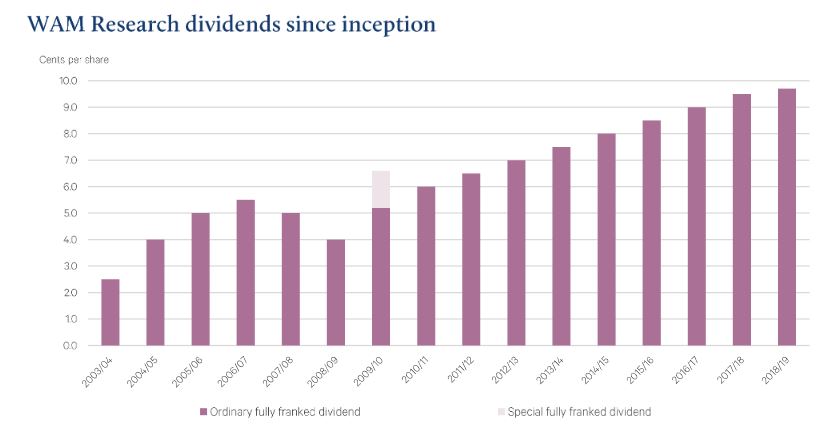

Well, WAM Research not only offers a market-beating yield, it also has a phenomenal history of providing a consistently rising income, as you can see below.

Source: Wilson Asset Management

The company's most recent final dividend was a 4.85 cents per share payout, which left its profit reserves standing at 27.25 cents per share. On these numbers, I am more than convinced WAM Research's dividend is sustainable in both the short- and medium-term (not too good to be true after all). Even better, it looks to be sufficiently adequate to keep the dollars rolling in even if there is some kind of significant market crash in the near future.

Foolish takeaway

Although I generally don't like buying assets at a premium price, I think that WAX shares offer a lot to income investors today regardless. Such a high yield is rare on the ASX but a sustainable one is even rarer – this perhaps justifying the pricing premium for anyone reliant on dividend income.