On Tuesday the Reserve Bank of Australia will meet once again to make a decision on the cash rate.

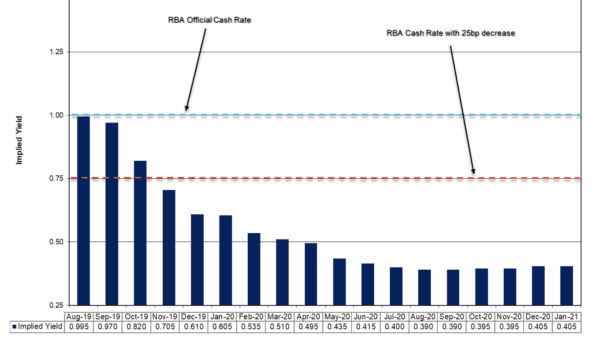

Whilst the market is confident that there will be no changes made this month, it is worth noting that a cut to 0.75% has been priced in by November by the market.

After which, a further cut to 0.5% is expected in March according to current cash rate futures contracts. This can be seen on the chart below from the ASX.

In light of this, I continue to believe that the dividend shares listed below would be better options for income investors than term deposits right now. Here's why I like them:

National Storage REIT (ASX: NSR)

National Storage is one of the largest self-storage providers in the ANZ market with a total of 164 centres. Thanks to a combination of increasing demand, development projects, and its growth through acquisition strategy, I believe National Storage is well-positioned to grow its income and distribution at a solid rate over the coming years. At present its shares offer a forward yield of around 5.3%.

Scentre Group (ASX: SCG)

Scentre Group is the owner of all the Westfield properties in the ANZ region. Due to the quality of these assets and the strong demand it has for tenancies, I believe the company is well-placed to grow its distribution at a steady rate over the next few years. At present its units offer a trailing 5.5% distribution yield.

Transurban Group (ASX: TCL)

Another dividend share to consider is this toll road giant. I think it could be a great option for income investors due to the quality of its assets, its strong pricing power, and long track record of distribution increases. In FY 2020 the company intends to increase its distribution by 5.1% to 62 cents per security, which equates to a forward 4.15% forward yield.