This morning high-flying property investment group Charter Hall Group (ASX: CHC) released its results for the financial year ending June 30, 2019. Below is a summary of the results with comparisons to the prior year.

- Revenue of $358.7m, up 53.7%

- Statutory profit of $235.3m

- Basis EPS 50.6cps, down 6%

- Operating earnings of $220.7m, or operating EPS 47.4cps, up 25%

- Final dividend of 17.2cps, dividends of 33.7cps, up 6% (40cps grossed up for franking)

- Managed $30.4 billion of FUM at June 30, with $4.2 billion of FUM growth post-balance date to $34.6 billion

- Property Investments up $138 million to $1.8 billion, a 9.1% return for the year

- Raised $3.4 billion of gross equity for the year

- Completed $5 billion in gross transactions

- Post tax return on equity 12.4%, compared to 10.5%

- Balance sheet gearing 5.7% (calculated as interest-bearing debt drawn excluding hedged FX movements subsequent to the related debt drawing date and DCSF net of cash, divided by total assets net of cash, derivative assets and DCSF.)

- Look though gearing 30.7%

Charter Hall's CEO, David Harrison said: "FY19 was an exceptional year for the group. It was a record year for equity raising, with all sources of equity active and $3.4 billion of new equity inflow across the platform. This then translated into our largest ever year for transactions, with $5.0 billion of gross transactions and $3.3 billion of net acquisitions."

Charter Hall shares are up 70% over the past year as investors buy into its aggressive acquisitive and capital raising growth story with the group completing deals to buy Folkstone Property Group, Sydney's Chiefley Tower for $1.8 billion, and other prime real estate in Sydney, Melbourne and Brisbane since this July.

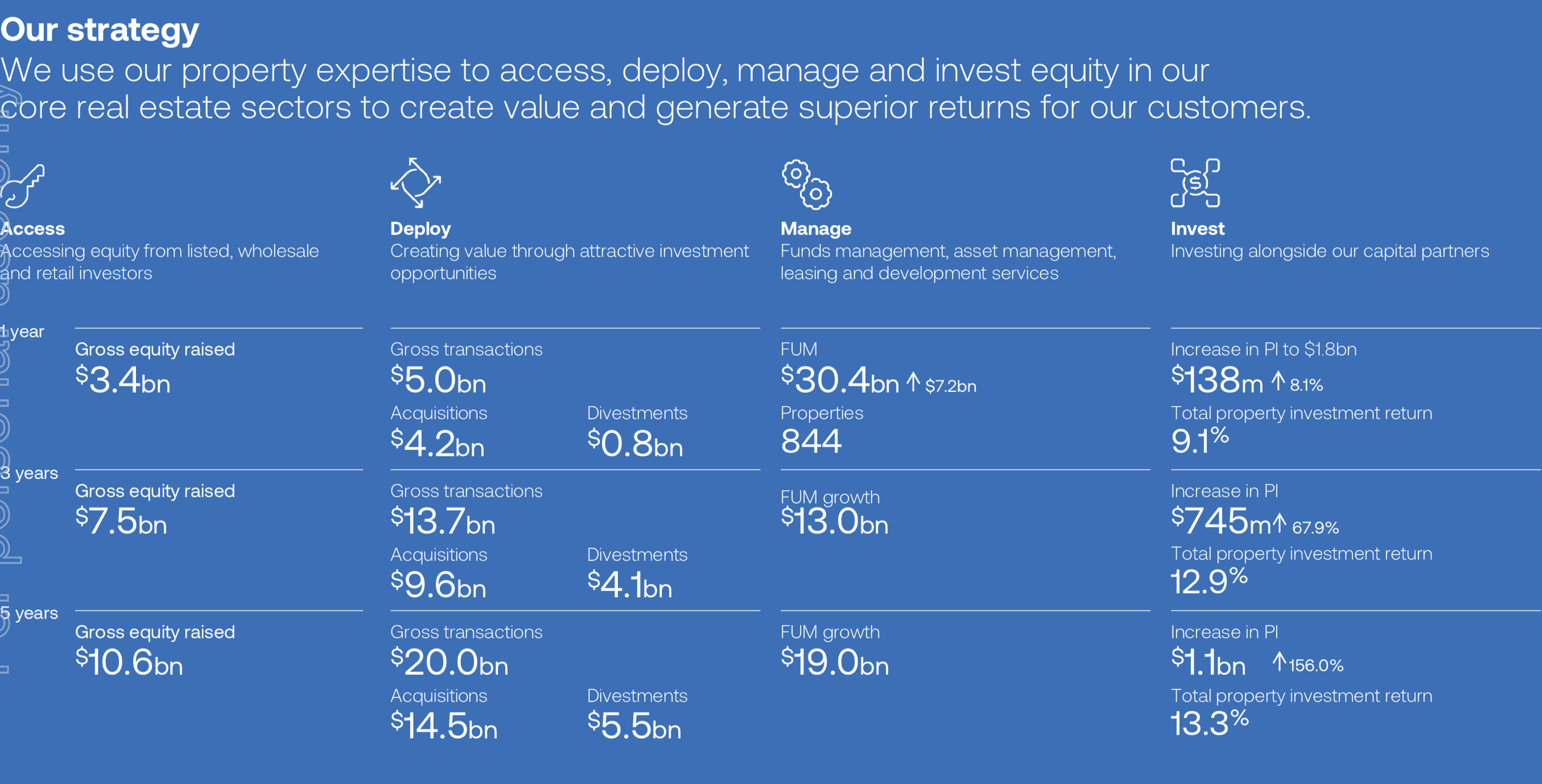

The group's strategy, financials, and reporting structure are complex, but the chart below gives investors a feel for its business model.

Source: Charter Hall presentation, Aug 20, 2019.

Driving the growth is an increased investor willingness to tip in funds for the company to recycle at profitable returns into commercial property leasing or collective investments.

Generally then the group benefits as commercial property values and FUM rise, with rent rises imposed on tenants another way to maintain yields that are commonly above 6%. Famous Charter Hall tenants include the likes of Telstra Corporation Ltd (ASX: TLS), Woolworths Group Ltd (ASX: WOW), and Coles Group Ltd (ASX: COL).

Outlook

Charter Hall is guiding for normalised operating earnings per share growth of 11%-13% in FY 2020, with distributions per security up a more modest 6%. Still in today's ultra-low cash rate world it's not hard to see why investors have bid the stock higher given lower cash rates generally equal rising property prices.

At $12.02 it trades on 23x the mid point of its forecast FY 2020 earnings per share, with a forward yield likely to be around 2.9% plus franking credits.