The Reserve Bank of New Zealand (RBNZ) has torpedoed the Kiwi dollar this morning by cutting cash rates 50bps to 1% and dragged the Australian dollar 1% lower with it to a post-GFC low of just US66.9 cents versus the US dollar.

The RBNZ's surprise decision to lop 50bps rather than 25bps off rates has caught currency market makers by surprise with the NZ dollar dropping 2% versus the US dollar to buy just US63.9 cents as at 13.20pm AEST.

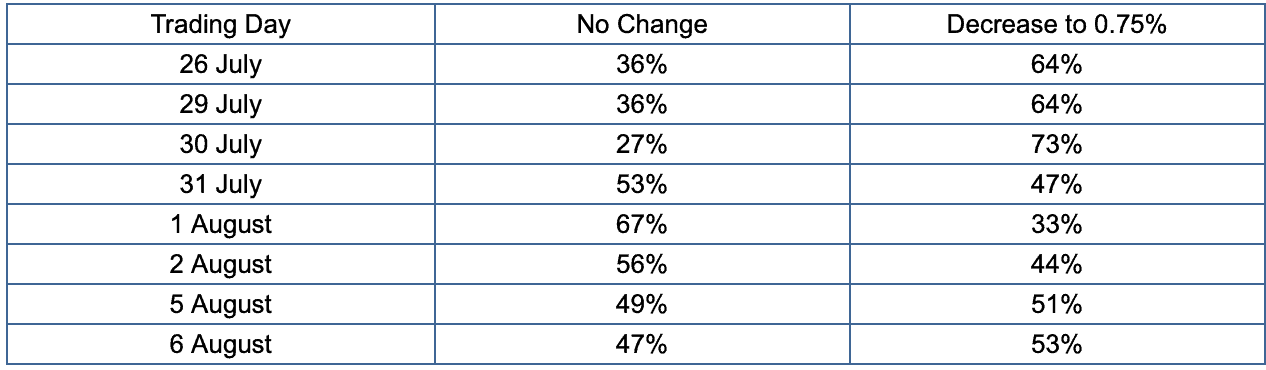

Cash rate futures traders were already pricing in more than a one in two chance of the RBA cutting rates 25bps to 0.75% this September and will be lifting those bets this afternoon as shown by the 1% fall in the Aussie this morning.

Source: ASX website, August 7, 2019.

For ANZ investors one important outcome of a tumbling NZ dollar is that some of arguably the ASX's best growth shares in Xero Limited (ASX: XRO) and the a2 Milk Co. Limited (ASX: a2M) still report profits in NZ dollars, with a weaker Kiwi likely to boost their bottom lines.

Gentrack Group Ltd (ASX: GTK) is another high-flying NZ-based software business with a lot of overseas earnings in line to receive a bottom line boost.

While another Kiwi company in SaaS-based digital tithe merchant Pushpay Holdings Ltd (ASX: PPH) actually reports in US dollars, but if it ever were to pay dividends to its Kiwi shareholder base for example they would be more valuable with a weaker NZ dollar.