The Megaport Ltd (ASX: MP1) share price has pushed higher this morning after the provider of elasticity connectivity and network services released its latest quarterly update.

At the time of writing the Megaport share price is up 2.5% to $7.09.

What happened in the fourth quarter?

During the fourth quarter Megaport continued its growth trajectory with another solid performance.

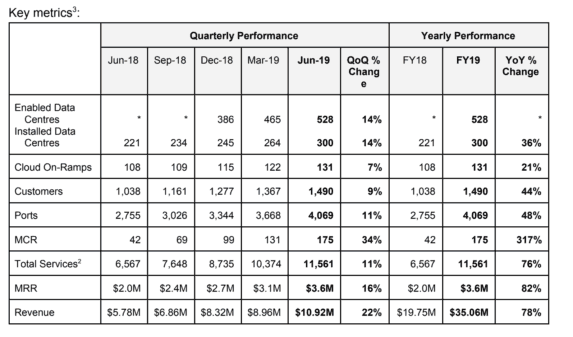

According to the release, the company achieved a 22% increase in total revenue for the quarter ending June 2019 and a 78% increase for the full year. This led to Megaport reporting a 16% lift in its Monthly Recurring Revenue (MRR) during the quarter and a massive 82% for the full year.

A key driver of this growth was the company's continued expansion of its network footprint into new markets and the deepening of its reach within existing metros. By the end of the fourth quarter the company had reached a milestone of 300 installed locations and 528 enabled locations globally.

New partnerships included 365 Data Centers, Bluebird Network, Evoque, Digiplex, Ficolo, and Telia.

In addition to this, Megaport also released new features to Megaport Cloud Router (MCR 2.0) and expanded MCR service availability to more locations to drive further adoption of cloud connectivity services.

Shown below is a summary of the company's key metrics, which all continued to improve during the latest quarter.

The company's chief executive officer, Vincent English, was pleased with the final quarter performance.

He said: "The fourth quarter of Fiscal Year 2019 brought the strongest performance for Monthly Recurring Revenue to date at $3.6M. The combination of accelerating Port sales and increased adoption of services across the platform, up 11% from the previous quarter, enabled us to book a solid $3.6M of MRR. Our 36 Installed Data Centres in the quarter are the result of recent new partnerships and our continued drive to expand to locations with enterprise demand for cloud connectivity. Several of these new locations have bolstered our footprint in Europe where, as a market, cloud adoption is accelerating."

Pleasingly for shareholders, Mr English appears confident in the company's outlook.

He added: "Reaching our 300 installed locations target for the fiscal year is a testament to the team's ability to execute. Coupled with new features and the expanded reach of Megaport Cloud Router, Megaport is well positioned to address the global market demand for connectivity."

Elsewhere in the tech sector on Tuesday, the Altium Limited (ASX: ALU) share price and the Xero Limited (ASX: XRO) share price have followed the lead of the Nasdaq index and pushed higher in early trade.