The Independence Group Ltd (ASX: IGO) share price is 3% or 15 cents to $4.94 today after the nickel, copper, cobalt and gold miner reported its metal production numbers for the quarter ending June 30, 2019.

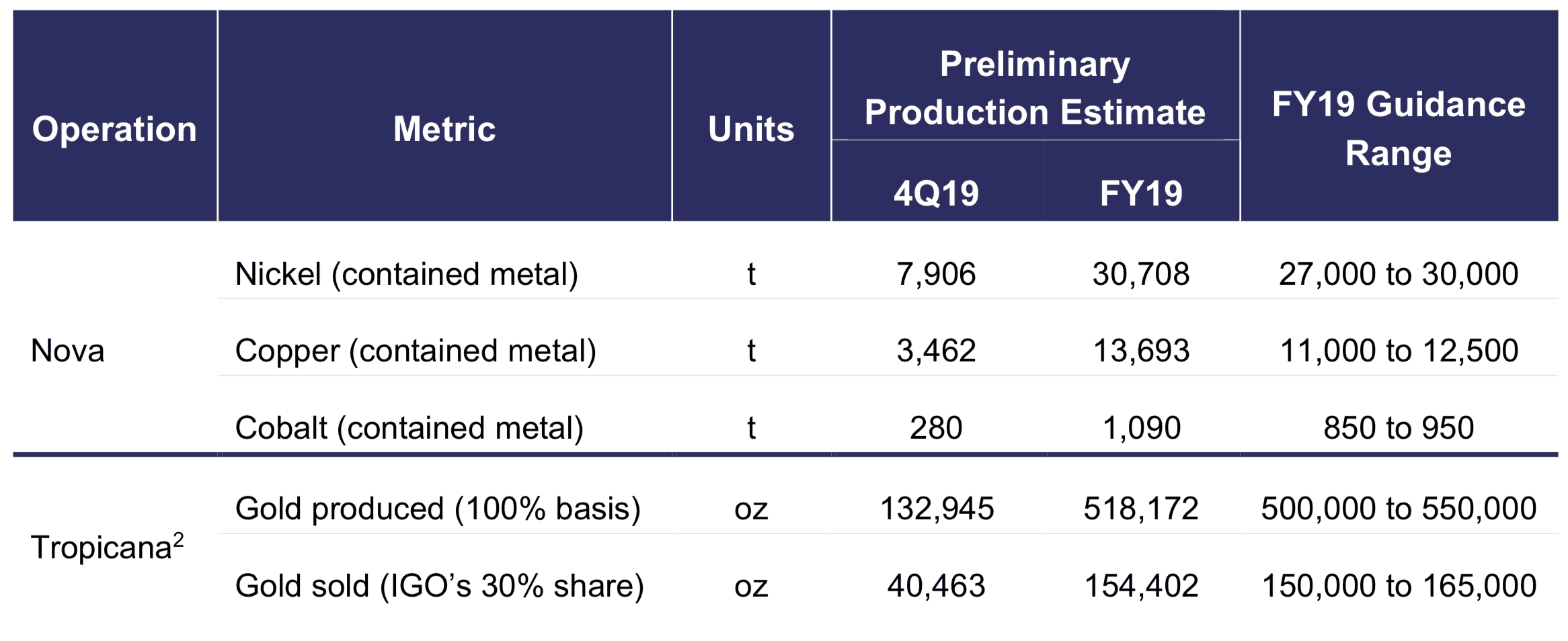

The good news is that production from its Nova nickel, copper and cobalt mine exceeded full year production guidance, while production at its Tropicana gold mine also came in within the full year guidance range. As we can see from the chart below.

Source: Independence Group presentation, July 4, 2019.

"Strong operating discipline and ongoing optimisation at Nova has delivered nickel production rates which have exceeded the average production rate determined in the Feasibility Study for each of the last five quarters. With capital development and grade control drilling substantially completed during FY19, Nova is positioned to continue to deliver strong results into FY20," commented Independence Group's CEO Peter Bradford.

Other gold miners such as St Barbara Ltd (ASX: SBM), Northern Star Resources Ltd (ASX: NST) and Newcrest Mining Limited (ASX: NCM) have also been racing higher recently as the gold price passes A$2,000 per ounce.