In morning trade the Class Ltd (ASX: CL1) share price has pushed higher following the release of its latest quarterly update.

At the time of writing the SMSF platform provider's shares are up 1.5% to $1.47.

What happened in the June quarter?

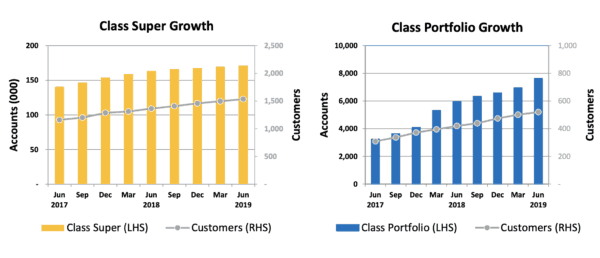

During the June quarter the company's growth continued to be challenged. Class reported a 2,461 increase in accounts to 179,082 and an increase in customers by 39 to a total of 1,545.

As you can see below, the Class Super offering grew by 1,787 accounts (net of ~300 AMP suspensions) to 171,447 and Class Portfolio increased to 7,635 accounts. Approximately 33% of Class Super customers now use the Class Portfolio product.

The company's new CEO and managing director, Andrew Russell, acknowledged that its growth was underwhelming, but appears optimistic on the future.

He said: "Undoubtedly, the June quarter growth levels have remained under pressure. Now, with a clearer picture on franking credits policy and a renewed focus on product, marketing and sales, we have a platform on which to build momentum for growth."

Mr Russell also sees a lot of benefit in its recent agreement with Findex.

Adding: "Earlier this week we announced that we have signed wealth accounting group Findex to provide a trust accounting solution for their family office clients. As part of this agreement, Class will develop a range of features that will fully automate and simplify complex trust accounting requirements and deliver unprecedented efficiencies for Findex. These new trust accounting features will deliver these same benefits to other Australian accounting firms managing these complex investment entities."

Elsewhere in the industry, the HUB24 Ltd (ASX: HUB) share price and the Netwealth Group Ltd (ASX: NWL) share price have continued to sink lower after falling heavily on Wednesday due to concerns over the cash returns provided through their platforms following the cash rate cut.