If you're in your 40s, it really is time to start pondering your retirement beyond your employer's super contributions. If your default New Year's resolution every year is to consolidate all those super accounts you've accrued over the years, wait no longer and get it done. You're already bleeding valuable retirement dollars through fees and replicated insurance products. In the end it could mean the difference between a post retirement trip to Venice or Victor Harbor. In fairness to South Australians, Victor is a lovely spot too!

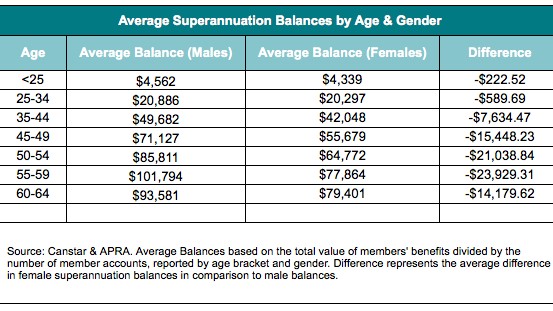

Side note to the ladies reading this, you've got an even more urgent reason to complete your super consolidation. The table below paints a concerning picture on average super balances.

Once you've completed this important piece of life administration it's time to think about other types of investments that could enhance your position on retirement day. Here's a couple of lower risk, quite conservative suggestions I'd think about purchasing and then leaving in a drawer.

Wesfarmers Limited (ASX: WES)

Wesfarmers is an enormous, diversified, mega-corporation with so many well-known brands like Kmart, Bunnings, Target, and Officeworks. There's also whole range of other products including chemicals, energy, fertilisers, and industrial and safety gear.

Wesfarmers is trading today at $36.27, and has provided investors with a 2.72% increase in share value over the past year. I'm fine with growth in the 2–3% zone if it's consistent and there's a reasonable dividend. It probably says a lot about my aversion to risk! Speaking of dividends, you get $2.20 per share fully franked, and I'd strongly recommend using your dividends to buy more shares until that retirement date is firmly circled on the calendar.

Transurban Group (ASX: TCL)

If you live in one of our big cities, you understand traffic congestion and toll roads and you probably like neither of those things. However, you might like to be an owner of some Transurban shares. The company designed and manages 17 toll road networks across Australia and the United States with several new projects in the pipeline, and purports to have 8.5 million customers.

I can say from personal experience that the relatively new Legacy Way tunnel has made the Brisbane airport dash a much calmer affair. Despite the early pang of annoyance we all feel when we drive under the toll scanners, I absolutely appreciate the lighter traffic and faster trip, door-to-door. Transurban closed yesterday at $15.29, highlighting 27.21% in share growth in just the past year. You'll also receive a partially franked dividend of 59c per share (3.86% dividend yield).

Foolish takeaway

With my Wesfarmers and Transurban dividends I'd really try and have the discipline to continually reinvest them in more of the same shares, with the intention of pulling those shares out of the drawer on retirement day to a very healthy balance.