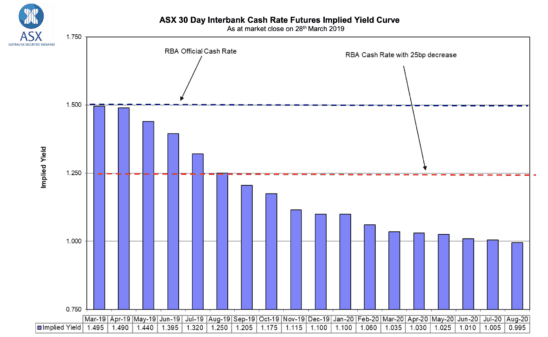

The probability of the Reserve Bank cutting rates at its meeting next week currently stands at just 4% according to the latest ASX 30 day interbank cash rate futures.

However, looking ahead, cash rate futures are pointing to two cuts within the next 18 months. This can be seen on the chart below.

Whilst a lot can change in the space of 18 months, I think recent economic data means this is a real possibility and something that investors ought to be prepared for.

In light of this, if I had $20,000 sitting in a bank account, I would put it to work in the share market instead of having it gain only paltry interest in a bank account or with a term deposit.

Here's where I would invest these funds:

Australia and New Zealand Banking Group (ASX: ANZ)

If you don't already have meaningful exposure to the banks then I think now could be an opportune time to pick up shares. Especially after a recent pullback in the ANZ share price brought its shares down to a very attractive level for both value and income investors. At present ANZ's shares offer investors a trailing fully franked 6.1% dividend yield.

NEXTDC Ltd (ASX: NXT)

I think that this leading data centre operator could be a great long-term investment. Due to the cloud computing boom, more and more data is being produced by consumers and businesses. This has led to increasing demand for data centre services and put NEXTDC in a great position to profit. Its world-class data centres saw contracted utilisation increase 28% to 50.4MW in the first half, leading to a 26% increase in underlying EBITDA to $42.2 million. I'm confident there will be more of the same over the next decade, making it worth considering for investors with a high tolerance for risk.

ResMed Inc. (ASX: RMD)

Another growth share that I would consider investing the $20,000 into is ResMed. It is a sleep treatment-focused medical device company which has been growing at an impressive rate over the last decade. Pleasingly, due to the quality of its products and its growing addressable market, I feel that ResMed is well-positioned to continue growing strongly for the foreseeable future. This could make it a great buy and hold option.