The Platinum Asset Management Limited (ASX: PTM) share price fell 7% to hit a 52-week low of $4.52 this morning and is not far off a 5-year low of $4.34 after the international equities manager warned it would "receive little in the way of absolute return performance fee income for the half-year ending 31 December 2018".

It also warned it would record "an unrealised loss" on recent seed investments due to falling equity markets.

Hedge fund managers like Platinum run popular "absolute return" or "long short" strategies to offer potential investors outperformance in falling markets by using call or put options and by shorting stocks they expect to fall.

If a hedge fund manger can outperform its benchmark index it's usually entitled to lucrative performance fees, with hedge funds commonly able to charge a 2% and 20% model where fixed fees on total funds under management are 2% p.a. plus 20% of any outperformance of the benchmark.

This is a lucrative business model justified by the "complexity" of the strategies that has come under fee pressure recently, but performance fees at whatever fixed rate generally still offer lucrative returns for successful fund managers.

Unfortunately for Platinum investors its expectation that it will receive "little" in the way of performance fees from its absolute return strategies suggests its funds have failed to outperform their benchmarks.

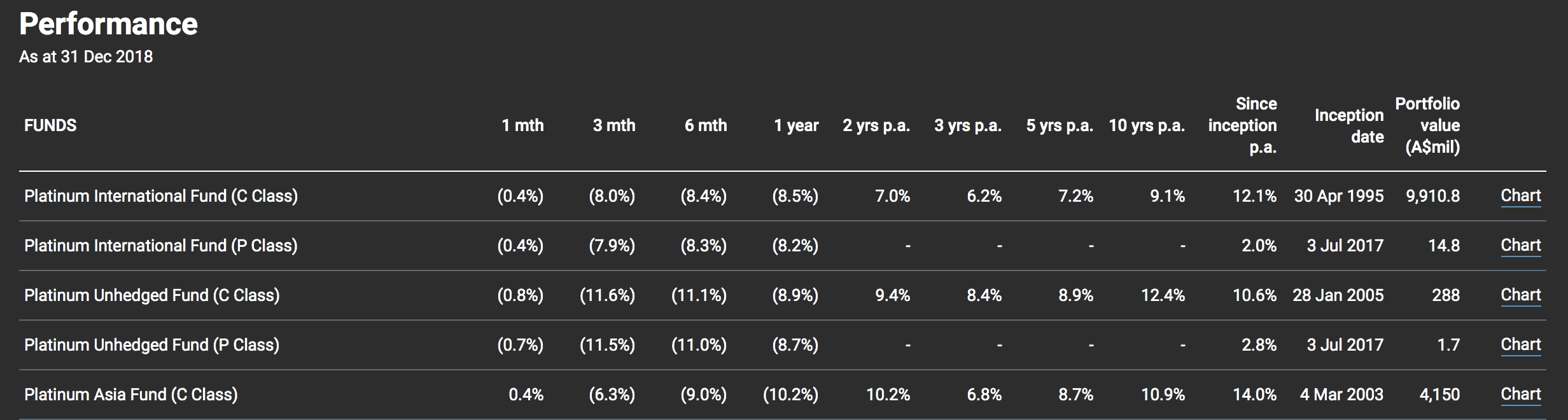

The table below shows the negative performance of two of Platinum's flagship funds, the Platinum International Fund and Platinum Asia Fund over the past 3 years. These two funds together total $14 billion of FUM or more than half of Platinum's total FUM of $24 billion.

Source: Platinum Asset Management website Jan 9, 2018

Source: Platinum Asset Management website Jan 9, 2018

Platinum is focused on more volatile Asian equity markets but the five-year returns of these funds hardly inspire and it's not hard to see why the business has struggled to attract additional investors.

Institutional investors and their powerful advisers instinctively look to 5-year performance track records for example, before listening to the pitches of CEOs, portfolio managers and institutional business development teams.

I cannot pass judgement on the expertise of Platinum's portfolio managers as the past performance shows much more than my opinion, but I must admit to choking on my cornflakes last weekend when reading in the Australian Financial Review that its "top short pick" for 2019 was U.S. database disruptor MongoDB. The cloud operator is already up 10% since January 2 and growing rapidly, albeit on a sky-high valuation.

Whatever happens to MongoDB is not material to Platinum's future though, as what will really count is overall investment performance and fund flows.

Platinum still largely outsources institutional business development and retail distribution, which is unusual for a mid-size fund manager (this is an issue I have covered in more detail in previous articles) and the opposite approach of a business like Magellan Financial Group Ltd (ASX: MFG) that invests relatively heavily in these functions, but still maintains a low cost-to-income ratio.

Notably, Magellan stock is up 12% over the last two days and I expect will hit new record highs this financial year, while Platinum is near 5-year lows.

Strong investment performance could help Platinum turn itself around, but others with stronger operational performance like Magellan or even Macquarie Group Ltd (ASX: MQG) look better risk-adjusted bets to me.