One of the worst performers on the market on Wednesday has been the MNF Group Ltd (ASX: MNF) share price.

In morning trade the shares of the provider of internet-based telecommunication services fell as much as 10% to $4.66.

They have recovered slightly since then but are still down by a sizeable 9% at the time of writing.

Why have MNF Group's shares been smashed today?

This morning MNF Group announced its FY 2019 and FY 2020 guidance which incorporates the upcoming acquisition of the wholesale and enablement business from Inabox Group (ASX: IAB).

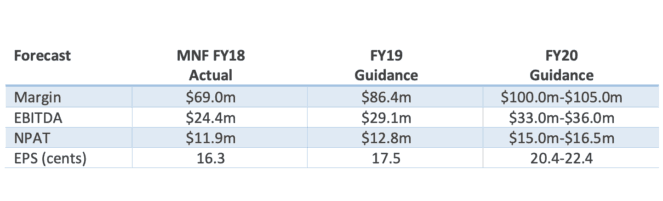

The company's guidance for the next two years in comparison to FY 2018 is shown on the table below. The FY 2019 forecast includes seven months contribution from the acquisition and includes funding costs and estimated amortisation expense.

As you can see above, earnings per share is expected to rise just 7.3% this year before accelerating to between 16.5% and 28% growth in FY 2020.

I suspect the market is disappointed with this year's forecast, which is understandable given that its shares were changing hands at 30x forward earnings prior to today.

I think this is expensive given its current growth profile, especially when you compare it to other growth shares that are available to be invested in.

As I mentioned earlier today, Aristocrat Leisure Limited (ASX: ALL) is expected to grow earnings per share by 40% this year and 26% next year. Yet its shares are priced at just 18x forward earnings.

It is a similar story for Bellamy's Australia Ltd (ASX: BAL) shares which are also trading at 18x estimated forward earnings.

Should you buy the dip?

While I do like MNF Group and believe it has solid long-term growth potential, I'm not a fan of its current valuation and would suggest investors wait for its shares to pull back even further before investing.

In the meantime, I see far more value in the shares of Aristocrat Leisure and Bellamy's.