The stubbornly strong price of coal has made our coal miners some of the best performers on the S&P/ASX 200 (Index:^AXJO) (ASX: XJO), but Credit Suisse believes some of the gains by the commodity are suspect.

The warning comes as the shares price of Whitehaven Coal Ltd (ASX: WHC) and New Hope Corporation Limited (ASX: NHC) have surged 109% and 34%, respectively, over the past 12 months when the top 200 stock index is up a mere 7%.

But Credit Suisse has cast doubt on one of the key sentiment drivers for the sector, the Newcastle spot coal price, which has been resiliently trading above US$110 a tonne even though the mineral is demonised as antiquated and polluting.

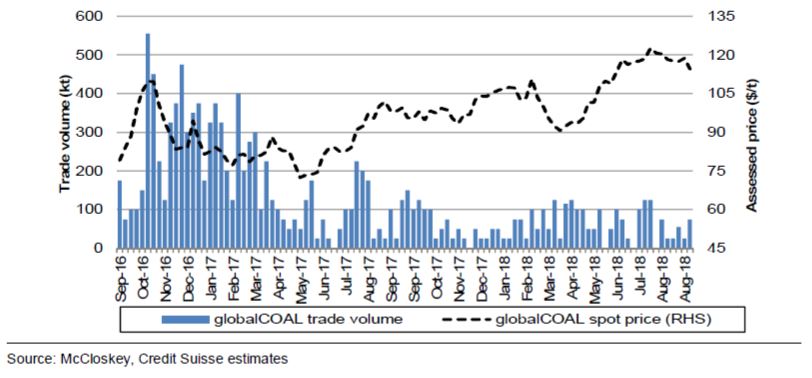

The high price may be a function of illiquidity and not demand. The broker looked at globalCOAL (a commonly used trading platform) trades over the past couple of years and noted that volumes have dried up as prices have jumped.

Coal Comfort: Newcastle globalCOAL fixed-price volumes per week & price

"About 3,000kt of coal is loaded at Newcastle each week, with two thirds high energy, but the globalCOAL price discovery this year has been based on average trades of 64kt per week," said Credit Suisse.

"Since late-July trading has shriveled to 40kt per week – or sometimes nil. It's hard to argue that 1% of the port volumes trickling out in 25kt parcels to an unknown entity provides a representative price."

There may be a logical explanation for this. The illiquidity could represent a real scarcity of high-energy coal as the broker believes export volumes from Richards Bay are declining.

But there may be a more sinister reason behind the pricing abnormality.

"Another explanation is that it could be intentional – an expression of the pricing power that major miners are beginning to exercise over the price following consolidation of producers in the Hunter Valley," said Credit Suisse.

"Major miners could ensure that their own sales avoid globalCOAL to keep visible pricing illiquid, while the price of larger volumes remains unknown, shrouded in confidential deals."

The broker noted McCloskey's reports that Glencore won a tender for multiple shiploads of high-energy coal to Korea at US$95 per tonne FOB [free on board].

It concluded that Glencore – the biggest Hunter Valley coal producer – would prefer to win contracts at lower prices than add liquidity to the spot market.

This isn't to say that the price of coal will collapse although the lack of transparency makes forecasting prices much trickier.

A better way to gain exposure to the commodity might be to buy a diversified miner like South32 Ltd (ASX: S32) as it also produces coal as well as a wide range of other minerals.