In morning trade the BWX Ltd (ASX: BWX) share price will be on watch after the release of the personal care products company's results for the 12 months ended June 30.

In FY 2018 BWX delivered a 104.6% increase in revenue to $148.7 million, a 52.4% lift in normalised EBITDA to $40.3 million, and a 37.5% lift in normalised net profit after tax to $24.2 million. This led to diluted earnings per share of 16.6 cents and a final fully franked dividend of 4.2 cents per share.

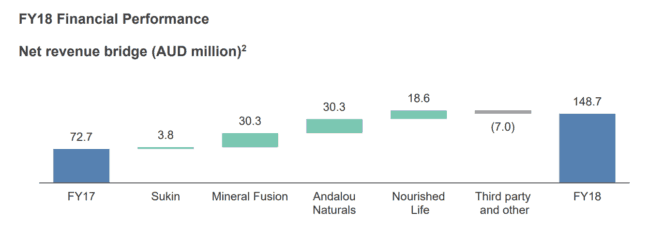

The main drivers of BWX's revenue growth in FY 2018 were its acquisitions of the Mineral Fusion, Andalou Naturals, and Nourished Life businesses. As you can see on the revenue bridge below, the addition of these acquired businesses helped to offset the soft growth of the company's key Sukin business. The latter grew sales by just 6.1% in FY 2018 despite its entry into the domestic grocery channel and ongoing international expansion.

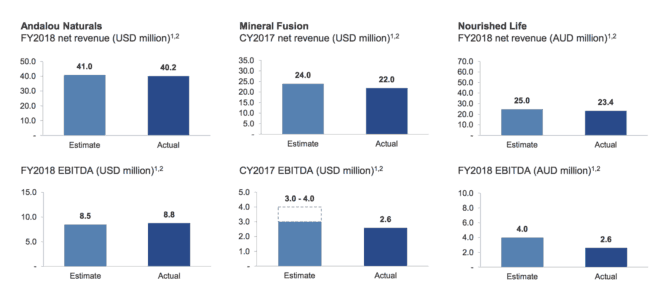

BWX's profits didn't grow as quickly as its sales because the acquired businesses have lower gross profit margins compared to the historical BWX business. As a result, BWX saw its gross profit margin fall to 59.4% in FY 2018 from 65.4% in FY 2017. In addition to this, the acquired businesses didn't perform quite as well as management had expected. As the table shows below, only the Andalou Naturals business hit its EBITDA target.

Also weighing on its margins was a 133.7% increase in operating expenses to $49.6 million. This was driven by investments in the Mineral Fusion and Andalou businesses, investments in the infrastructure and platform of Nourished Life, and a greater level of marketing investment to increase awareness for the Sukin brand. However, management believes that these investments and the fact that the integration of its acquired businesses is largely complete, means that BWX is well positioned to leverage its global platform for long term sustainable future growth.

Outlook.

Management has noted that the global beauty and personal care market continues to grow strongly with the global shift towards natural products accelerating, which it believes creates strong tailwinds for the company's brands.

Furthermore, it feels FY 2018 was a transformational year for the company and that recent acquisitions in conjunction with organic initiatives implemented have provided it with a solid foundation for growth in FY 2019.

It expects the FY 2019 financial performance to be strong across all geographic regions and the entire brand portfolio, but stopped short of providing any real guidance.

Should you invest?

While I thought this was a reasonably mixed full year result, I do agree with management that BWX is well positioned to benefit from the shift to natural products. This could make it worth considering BWX as a buy and hold investment option.

However, due to all the drama going on behind the scenes, I don't plan to make an investment at this stage. Instead, I would look at other retail shares such as Noni B Limited (ASX: NBL) or Super Retail Group Ltd (ASX: SUL).