The Wesfarmers Ltd (ASX: WES) share price rose 4% to $52.44 this morning following publication of its full year results.

Revenues grew 3% to $66.9 billion, while revenue from discontinued operations (the coal mine and Wesfarmers UK) fell 15% to $3 billion. Net profit after tax was down 58% to $1.2 billion, largely due to the billion-plus dollars that Wesfarmers torched on its UK Bunnings venture.

Wesfarmers reported earnings per share of 105.8 cents after accounting for losses at discontinued businesses. From continuing businesses, Wesfarmers earned 230.2 cents per share.

My view is that the former figure is more accurate, as a large part of the Wesfarmers' business case relies on management allocating capital wisely, and the company lost a lot of money on bad investments this year.

Wesfarmers paid 223 cents per share in dividends, fully franked, flat on last year.

Wesfarmers ended the year with net debt of $3.6 billion, down from $4.3 billion previously. The company has closed its Bunnings venture and sold its Curragh coal mine, and recently announced plans to divest its Kmart Tyre & Auto business.

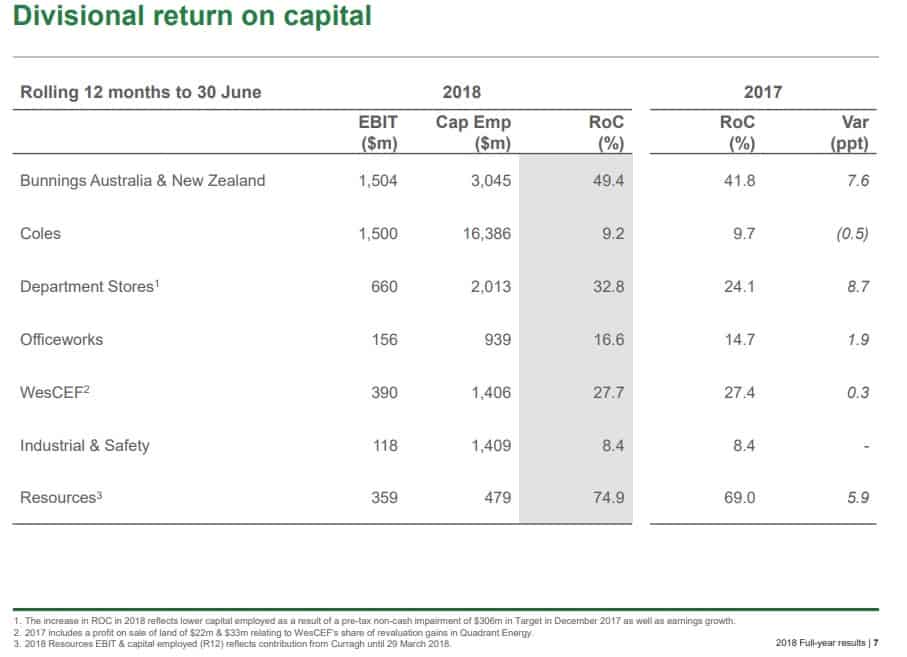

Bunnings continues to be the bright spot of the business, posting an astonishing 49% return on capital this year:

The interesting implication of the recent failure in the UK and the failure of Woolworths Limited's (ASX: WOW) Masters' Hardware, in my opinion, is that investors might have to question whether Wesfarmers just got lucky with Bunnings.

Sure it's a great business and very well run, but it was able to roll out and dominate the hardware industry and create a sizeable moat with virtually zero major competitors until after it was established. As far as I can tell, the UK marketplace is substantially more competitive.

Of course, Wesfarmers made exactly the same mistake in the UK that Woolworths made in Australia with Masters just a couple of years ago. It launched into a market where it had limited prior experience, made a massive roll out of stores (in Wesfarmers' case, they acquired them), and performed abysmally.

The one saving grace is that Wesfarmers pulled the plug quickly before it became a multi-year sinkhole like Masters.

Still as an investor I would expect that a conglomerate, whose major business is allocating capital, might have learned lessons from Masters' identical mistake.

This is a big black mark against Wesfarmers in my opinion and, all else being equal, I would be inclined to be less optimistic about Wesfarmers in the future, once it is cashed up from all its divestments.

Speaking of which, Wesfarmers confirmed that the divestment of Coles is expected to be complete in November. As part of a group-wide outlook for 2019, the company stated that it would be well placed to return to earnings growth.

Management stated that: "The Group's strong balance sheet position, cash flow generation & capital discipline will be prioritised, enabling it to take advantage of growth opportunities to create value for shareholders over the long term." (emphasis added)

In the future, Wesfarmers' capital allocation decisions are going to be even more important. I would suggest shareholders file that statement away and keep it in mind when assessing Wesfarmers' future corporate (ad/misad)ventures. For now Wesfarmers' looks largely fully priced in the lead up to its Coles spin-off.