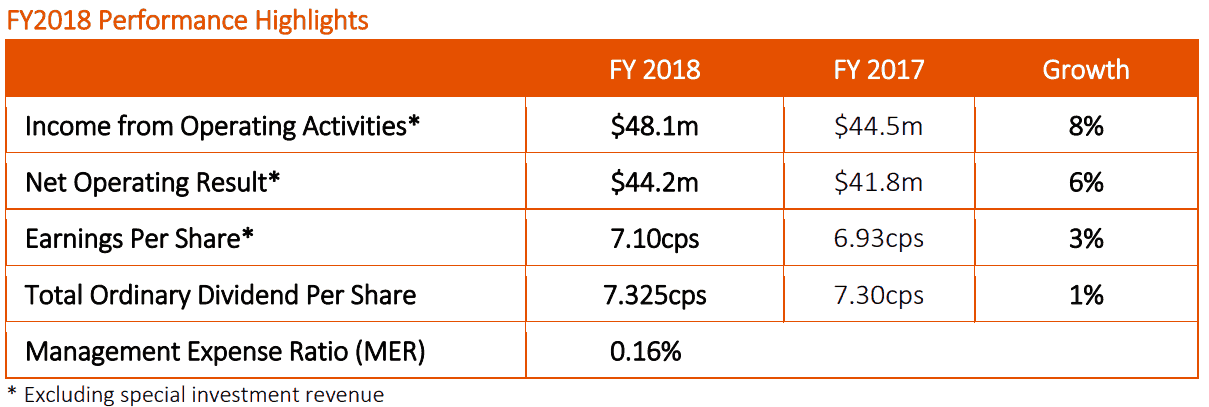

Listed investment company Bki Investment Co Ltd (ASX: BKI) announced its 2018 year end results today with earnings per share (EPS) up 3% to 7.10 cents per share.

Below are the financial highlights from the announcement:

Source: BKI Investment Co ASX announcement

The total dividend announced by the company for the year results in a 6.9% yield (including franking credits).

Telcos disappoint

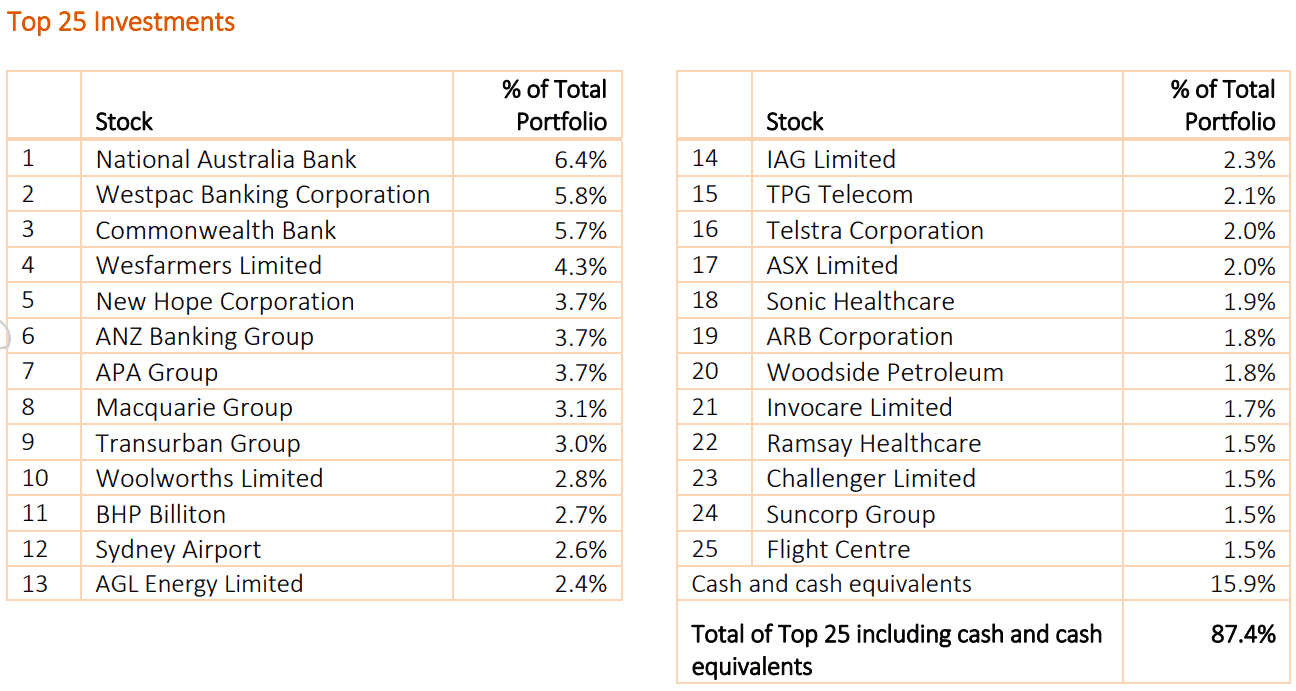

Whilst higher dividends received from top holdings such as Macquarie Group Ltd (ASX: MQG), Sydney Airport Holdings Pty Ltd (ASX: SYD) and AGL Energy Ltd (ASX: AGL) boosted the company's operating result, its telco holdings disappointed.

Investments in Telstra Corporation Ltd (ASX: TLS) and TPG Telecom Ltd (ASX: TPM) had a negative impact on the results, as the sector as a whole has gone through some structural challenges.

Cash dominates the portfolio

BKI Investment Co's strategy is to invest in a portfolio of high dividend yield companies with a sustainable business model, competitive advantages, a strong balance sheet and good management.

At the end of June, the company's top holding was in cash (16%) with the big banks National Australia Bank Ltd. (ASX: NAB), Westpac Banking Corp (ASX: WBC) and Commonwealth Bank of Australia (ASX: CBA) the other top positions.

The cash was raised in the recent entitlement offer and with the company expecting high market volatility to continue in FY 2019, they think it could, "prove to be a great opportunity for long term investors".

Foolish takeaway

Whilst BKI provides investors with instant diversification, its performance has not been much better than an index fund.

FY 2018 was not a poor year for BKI shareholders (total shareholder returns of only 0.1% vs the benchmark's 14.7%), and over the longer term, the company has returned an average of 10% per annum over the last 14 years which is the same as the benchmark.

They do however have a lower fee structure compared to other fund managers (shareholders are not charged a performance fee).

Investors considering BKI for its high dividend yield might want to read this FREE report.