It's the time of the year to undertake the obligatory investment exercise of looking for opportunities among the worst performing shares of the last year.

It's a strategy that is more commonly known as "Dogs of the Dow" where investors buy the worst performing stocks in the mega-cap US index on the belief that businesses move in cycles. What is down one year will almost surely rebound the next.

This theory has proven to be relatively fruitful for US investors and this usually prompts local investors to use the same trick on the ASX 100 (Index:^AXTO) (ASX:XTO).

The strategy doesn't carry over quite as well due to some distinct differences between the Dow Jones and ASX 100 index.

For one, the Dow is highly concentrated with only 30 stocks. These stocks are also far bigger in terms of market capitalisation and have a significant international footprint compared to our large cap index.

Perhaps more importantly, each company on the Dow have a disproportionately higher impact on the US economy (and vice-versa) than our top 100 stocks on our local economy. The business cycles are probably not quite the same.

This doesn't mean that we can't find 2018 stars among the dogs. But it does mean we have to be far more discerning in picking which dog to adopt.

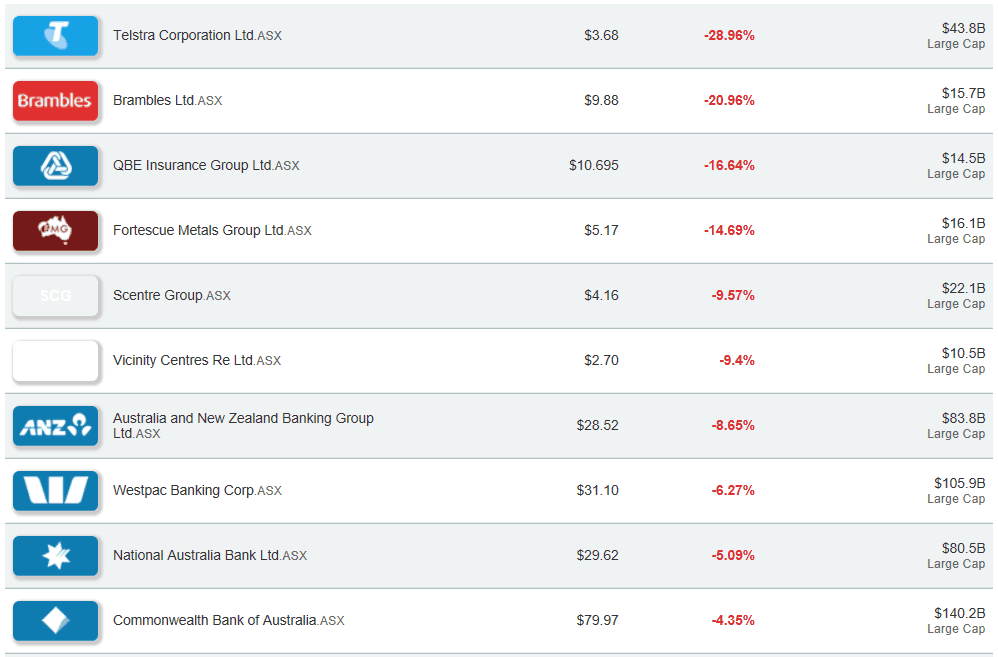

Worst Performing Large Cap Stocks Over the Past 12 Months

Source: NAB Trade

The wooden spoon goes to Australia's largest telco Telstra Corporation Ltd (ASX: TLS). Some analysts believe this is one to back for 2018 as its relatively generous net dividend yield of around 6% looks sustainable.

I think it's too early to call the bottom for Telstra as its competitive advantage (higher quality mobile network) is fast disappearing in the minds of consumers.

Number two and three on the list – global logistics group Brambles Limited (ASX: BXB) and insurer QBE Insurance Group Ltd (ASX: QBE) – look far more interesting to me.

This is in part due to their international footprint, greater exposure to the accelerating US economy and leverage to a falling Australian dollar.

It is also noteworthy to see the Big Four banks rounding out the bottom 10 list. Economists believe that the wage growth famine is coming to an end this year and employees can expect bigger pay packets in the face of a relatively tight labour market.

That can only be good news for the banks although I would still be avoiding Commonwealth Bank of Australia (ASX: CBA) due to governance concerns in favour of Westpac Banking Corp (ASX: WBC), National Australia Bank Ltd. (ASX: NAB) and Australia and New Zealand Banking Group (ASX: ANZ).

Don't only look among the losers for opportunities. The experts at the Motley Fool believe there are other blue-chips which are well placed to shine in 2018.

Click on the free link below to find out what these stocks are.