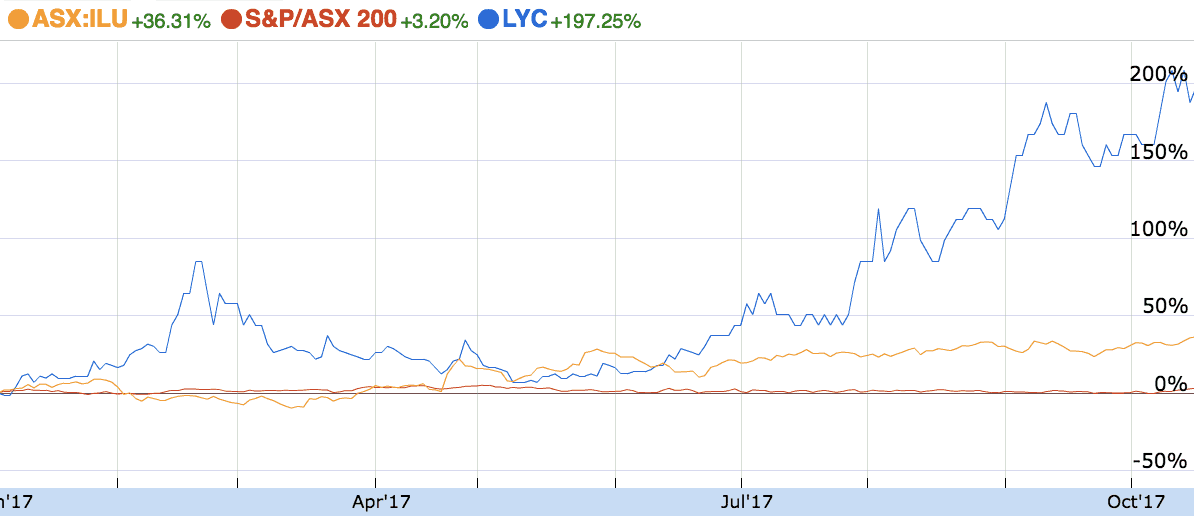

Shares of the $1.1 billion rare earths business Lynas Corporation Ltd (ASX: LYC) have come back from the brink in 2017 rallying nearly 200%.

Lynas share price

The chart above compares Lynas to Iluka Resources Limited (ASX: ILU) and the broader S&P/ASX 200 (Index: ^AXJO) (ASX: XJO) in 2017. As can be seen, it's been a good year for Lynas' owners. Unfortunately, their shares are still a long way off their all-time high.

During 2011, Lynas shares traded over $2.50 but now change hands for 22 cents. Fortunately, that's 110% higher than this time three months ago.

Why Lynas is rallying

Today's share price rise coincides with the release of Lynas' quarterly cashflow and activities report.

In the updates, the company said it was pleased to announce that its operating cash flow came in at a record $88.4 million.

It also reported record revenue of $112 million, up 108% on the prior corresponding period and 48% higher quarter-over-quarter. Production was up while costs were in-line with forecasts and some debt was repaid.

Looking ahead, the company is confident in its ability to strengthen its business, financially and operationally. It is targeting production of 500 tonnes of NdPr per month.

Foolish Takeaway

Unfortunately for long-term shareholders, Lynas has proven to be a 'gonna' company, so it will take some time before it's back in favour with investors.

However, the latest results appear promising, to say the least.

Therefore, although it is not the type of company that I would buy, it will be interesting to see if it can maintain its performance in 2017 and beyond.