The Telstra Corporation Ltd (ASX: TLS) share price has been crunched over the past two years but I'm not rushing out to get some for my portfolio.

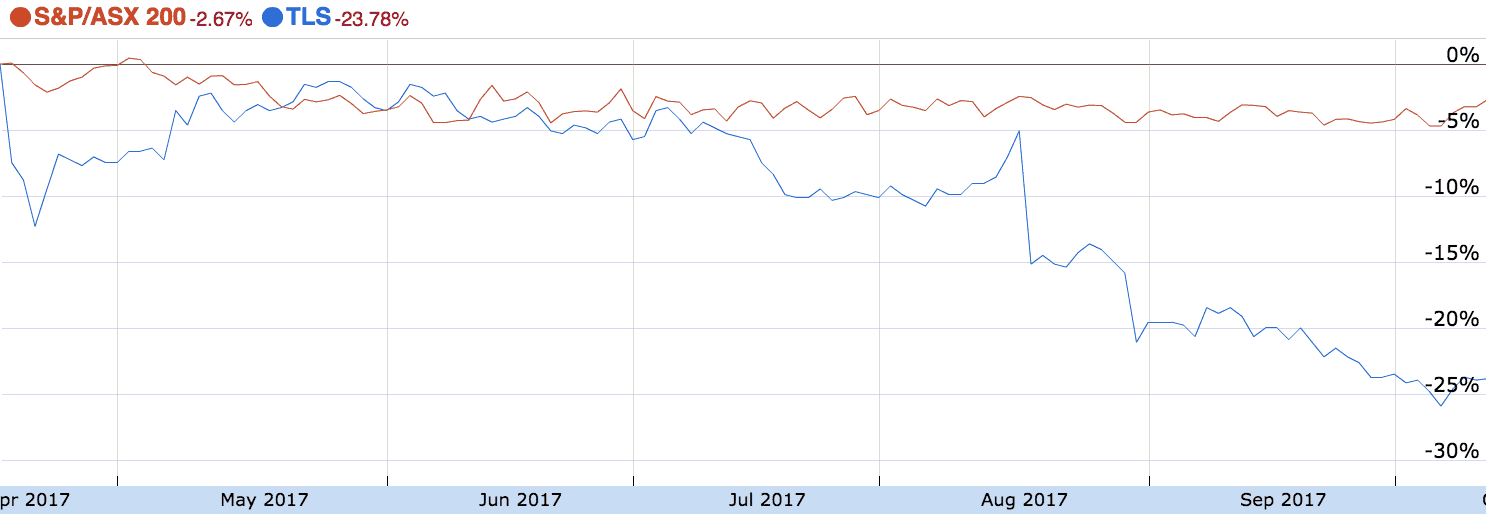

TLS share price in 2017

If Telstra's 2017 share price performance looks ominous, over the past 24 months it has fallen from over $6.50 to just $3.48 — a 46% decline. That compares to the market or S&P/ASX 200 (Index: ^AXJO) (ASX: XJO) which is up 9% over the same period.

Normally when shares of a high profile, market leading, dividend-paying company like Telstra falls from grace I'm quick to run the ruler over it.

Here's why Telstra shares are stuck on my watchlist and not in my portfolio.

3 reasons Telstra shares are stuck on my watchlist

- An NBN Elephant

The National Broadband Network is the elephant in the room. Although the government is yet to finish its rollout, the NBN has wreaked havoc with the share prices of broadband providers like TPG Telecom Ltd (ASX: TPM) and Vocus Group Ltd (ASX: VOC).

For Telstra, the NBN means it has lost its ability to charge other telcos to access its copper network. Together with new competitors, I suspect its profit margins will narrow and it could lose market share in this historically lucrative franchise.

- Mobiles

Telstra's mobile network is the best. Simple as that. It is the jewel in the crown of Australia's leading telecommunications business. Unfortunately, profit growth in mobiles may slow in coming years as new competitors emerge and data limits continue to expand.

I think the rollout of TPG's new mobile network is more likely to affect Optus, Vodafone and other lower-cost competitors than it will Telstra.

- Valuation.

Telstra shares look cheap, with a low P/E and decent dividend yield. But there is a difference between cheap and undervalued. I'm yet to get a proper handle on Telstra's valuation in the wake of its announcement that operating profit will fall by $3 billion (with a 'b') in the next couple of years.

Most of Telstra's value comes from its mobiles business and an assessment of whether that business is somewhat future-proof. Until such time that I have a better handle on its valuation, I'm not in a rush to buy shares.

Especially when there are thousands of other high-quality companies listed on stock markets around the world.