Every Friday, the U.S. Commodity Futures Trading Commission releases the Commitment of Traders (COT) report, which states the positioning of traders in the futures market for the week ending the prior Tuesday.

The COT report adds up the total holdings of participants in the U.S. Futures markets where currencies are traded on.

The report shows a breakdown of aggregate positions held by three different types of traders, commercial traders (hedgers), non-commercial traders (large speculators, hedge funds etc) and non-reportable (small speculators).

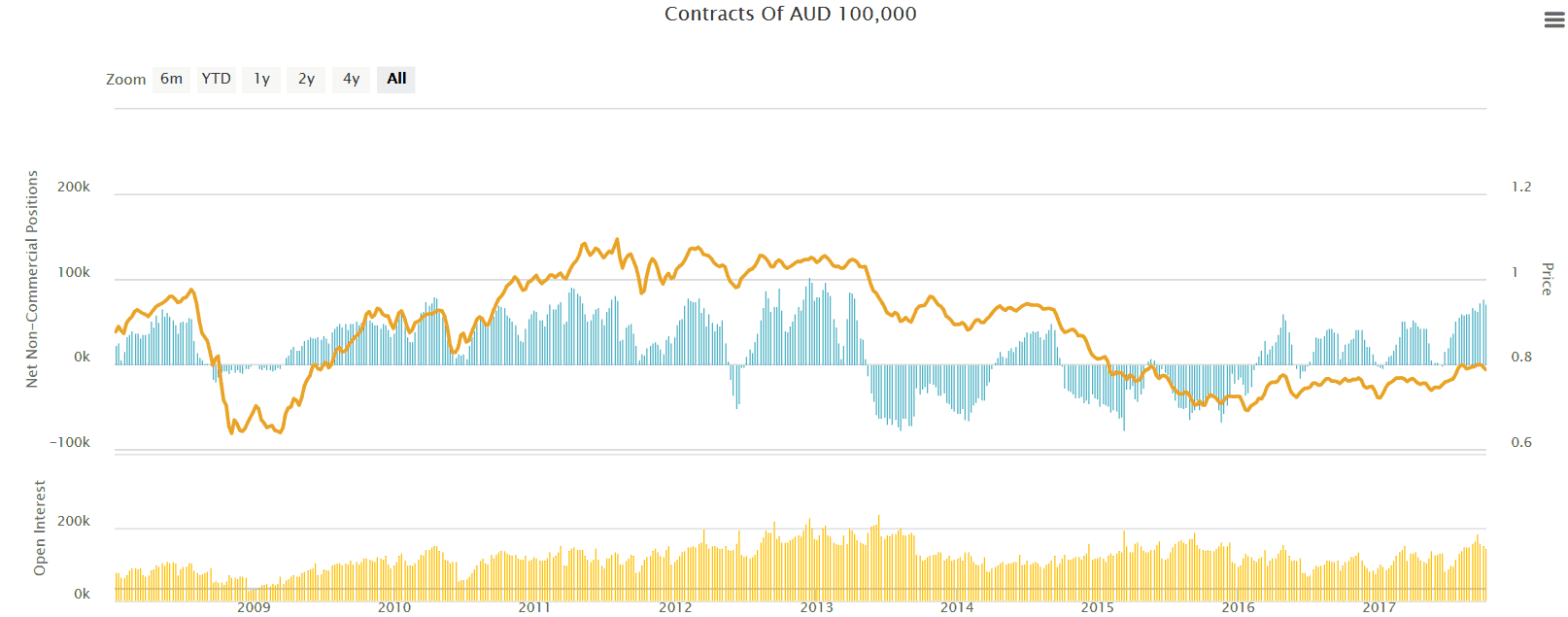

Of particular interest in the COT report is the net non-commercial positions number which aggregates the number of contracts held primarily by large speculators such as financial institutions and hedge funds.

Non-commercial positions are traded solely for speculative reasons i.e. buying or selling futures contracts and then closing these positions before the contracts are due for delivery.

The Aussie Dollar

For the purposes of the AUD/USD the amount of net non-commercial positions is particularly interesting as there is some correlation between the price of the AUD/USD and the trend of net non-commercial positions.

The week to Tuesday September 26 saw the highest number of net long non-commercial positions of 77k contracts since April 2013. In other words, towards the end of September, large financial institutions and hedge funds were the most bullish on the AUD/USD since April 2013.

Interestingly, in April 2013 at similar levels of bullish sentiment, the Australian dollar was trading around the $1.04 level.

Oanda Chart

Source: Oanda

Last Friday's COT report number of net non-commercial positions came in at 71k contracts long, a sharp reduction which reaffirms the recent weakness in the AUD/USD.

Friday's close at $0.7773 was the lowest weekly close since July. The failure of the AUD/USD to breach resistance at the $0.81 level twice in September is bearish in the near term.

AUD/USD Chart

Source: tradingview.com

ASX Impact

According to broker Morgan Stanley, the Australian dollar could remain vulnerable over the next 12 months due to lower commodity prices and weaker data out of China and it recommends staying short the AUD/USD.

A depreciating AUD/USD would benefit ASX listed companies who generate a substantial amount of revenue offshore in US dollars – such as Cochlear Limited (ASX: COH) and CSL Limited (ASX: CSL).

For example, Cochlear's FY18 guidance was at an average AUD/USD exchange rate of $0.80 cents. Consequently, a declining AUD/USD could have a material impact on the company's FY18 earnings.