The price of iron ore has fallen sharply in recent days, and is back at US$72/tonne, down from highs of $89 in March. Does this mean it's time to sell BHP Billiton Limited (ASX: BHP), Rio Tinto Limited (ASX: RIO), and Fortescue Metals Group Limited (ASX: FMG)?

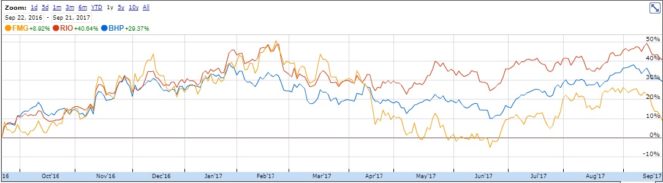

Each of the big iron ore miners has enjoyed a buoyant share price this year:

For investors, the important question is not what the price of iron ore is this week. At US$72/ tonne, each of the above miners is still nicely profitable and will be generating oodles of cash. The important question is whether the current price of iron ore is roughly the 'right' one, given the possible changes in supply and demand over the next decade. For example, at these low prices, there still isn't a significant amount of new mines being dug, and capital expenditure budgets (for exploration and expansion) are still subdued.

Likely, supply will not grow all that rapidly. So demand will probably be a more important driver of iron ore prices, and here you need to know that China imported over 1 billion tonnes of iron ore last year to feed its steel factories. This is more than 70% of all iron ore consumed worldwide. So demand is important, and Chinese demand is particularly crucial.

What do the Chinese construction and manufacturing industries (key consumers of iron ore) look like? That's a good question – they're certainly very busy, but you do not have to look hard to find reports of wasteful projects that generate less in income than the cost of the debt required to build them. Recently the media has been reporting on cuts to steel manufacturing capacity in order to reduce pollution.

Four major miners – BHP, Rio, Brazil's Vale SA, and Fortescue produce the overwhelming majority of China's iron ore, and the Aussie miners are its largest suppliers because of proximity. They are uniquely poised to benefit and/or suffer alongside the Chinese economy. Readers looking for a long-term investment need to have at least a grasp of the demand of iron ore, because a world with 30% less Chinese construction activity, for example, could be really bad for our miners. Due to the complexity and the risk, I think that investors are probably better off avoiding the sector entirely, or at least avoiding the iron-ore focused Fortescue and Rio.