Woolworths Limited (ASX: WOW) shares and Wesfarmers Ltd (ASX: WES) shares may not be a standout buy at this time.

Woolworths V. Wesfarmers share price

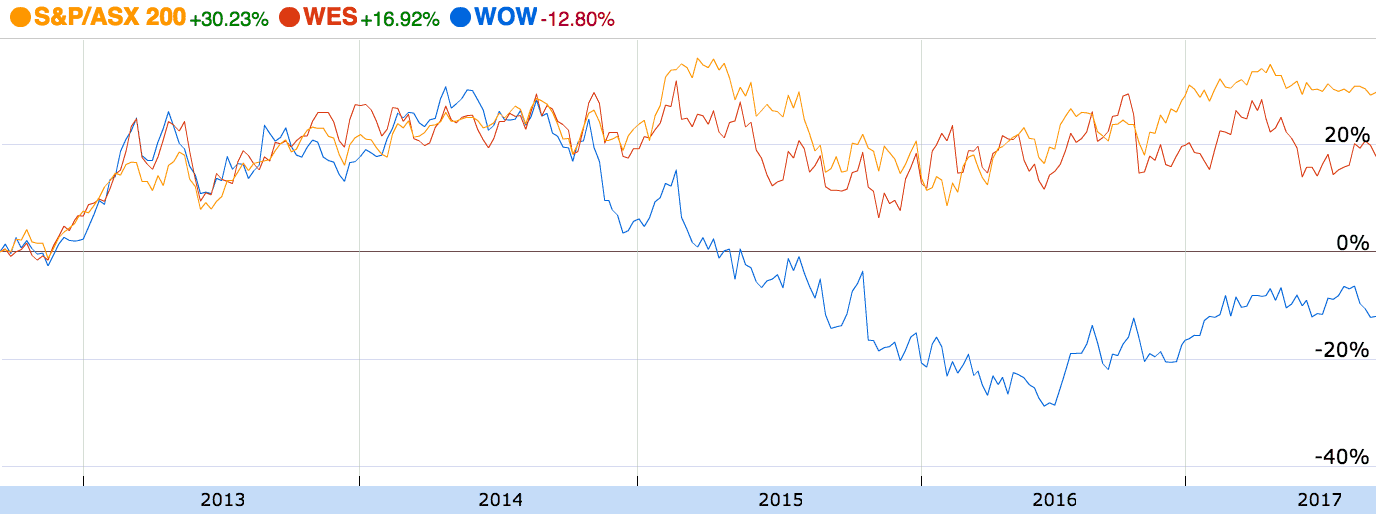

As can be seen above, the share prices of both retail heavyweights have underperformed the S&P/ASX 200 (Index: ^AXJO) (ASX: XJO) over the past five years. Woolworths has done especially poorly.

Wesfarmers

Until this year, Wesfarmers seemed invincible to the pressures that were afflicting other Aussie retailers. Bunnings Warehouse, the group's home improvement business, fired on all cylinders as a property boom wore on. Coles and Kmart were also kicking goals against their rivals Woolworths and Big W, respectively.

However, despite the Bunnings UK and Irish international expansion, Wesfarmers is now an active talking point amongst investors worried about the impact of Aldi and Amazon. Aldi has continued to grow under the nose of Coles and Woolies while Amazon is a serious threat to all retailers.

Woolworths

Following its failed attempt to challenge Bunnings in home improvement with its Masters franchise, Woolworths is back to focusing on its core strengths in supermarket and liquor retailing. The company has a renewed focus on customer satisfaction.

However, such priorities are likely to come at the expense of profit margins. Meaning, Woolies may be not able to quickly return to the lofty profits it reported in 2014.

Foolish Takeaway

In my opinion, Wesfarmers is the superior business. A potential divestment of Kmart, Target and Officeworks could be a good idea to avoid the threat of online giant Amazon. However, I would consider buying Wesfarmers shares only at a more compelling valuation than that which we are being offered today.

Woolworths also has its work cut out. However, like Wesfarmers, I believe its shares are also around fair value today. Meaning, I would need a lower share price before building a position in Woolworths shares in 2017.