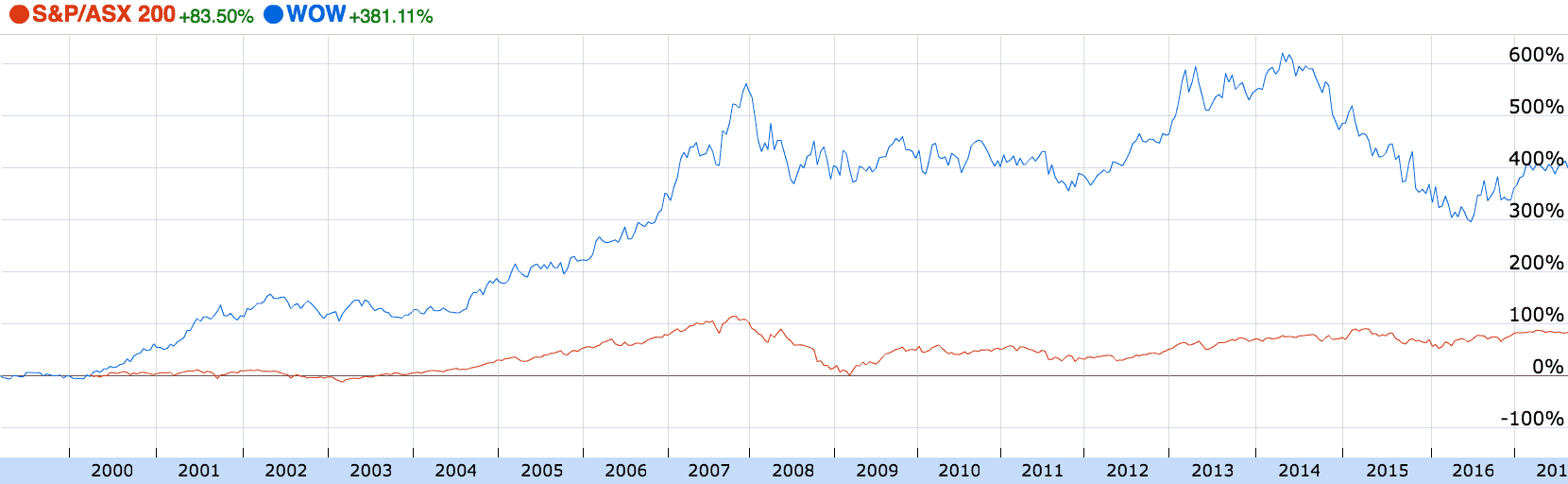

Over the ultra-long-term, the Woolworths Limited (ASX: WOW) share price has rallied strongly, outperforming the S&P/ASX 200 (Index: ^AXJO)(ASX: XJO) with dividends.

Woolworths Share Price V. ASX 200

However, despite the recent Woolworths share price fall, I'm reluctant to buy shares in the embattled supermarket company. Here are two reasons why:

1. Margin Compression is here to Stay.

In the glory days (2014), Woolworths had stretched its supermarket profit margins to 7% and who could blame them. The Masters Home Improvement joint venture with Lowe's was bleeding cash, so it had to get profits from somewhere.

Unfortunately, it squeezed too hard, and Coles, owned by Wesfarmers Ltd (ASX: WES), gathered pace as consumers switched to a lower-cost basket. In addition, Aldi was on its way to becoming a serious threat to Coles and Woolies, whether we believed it or not.

Now, Amazon Inc, the global e-commerce giant, is making its way down under. It will be a slow starter, but if its American and European success is anything to go by it will have a big impact on local supermarkets.

Together with the competition of its arch rival Coles, I think thinner margins are here to stay for Woolworths.

2. Other Opportunities.

Okay, this isn't a Woolworths issue. But, at any time, investors have 2,000 companies on the ASX — and more than 10,000 overseas — into which we can invest.

At $25, Woolworths shares offer a forecast dividend yield of 3.3% and trade at a premium valuation to the market. While it might be a decent investment at current levels, we are not compelled to make an investment simply because we can.

If I am investing for five or ten years into the future I want either a great valuation or a growing company. Unfortunately, I do not believe either of those things are on offer at today's prices.

Foolish Takeaway

Woolworths shares are around fair value today, in my opinion. Meaning, I do not believe they are significantly overvalued or undervalued at $25. Therefore, I'm not in a rush to buy or sell.

However, with the threat of more competition over time I would err on the side of caution if I was holding Woolworths shares, by keeping an eye on Amazon.