This morning investment conglomerate Washington H. Soul Pattinson and Co. Ltd (ASX: SOL) reported a statutory net profit down 7.1% to $247.9 million on revenue up 37% to $1,616 million for the fiscal year ending September 30, 2019. The company's adjusted profit from continuing operations fell 7.2% to $307.3 million.

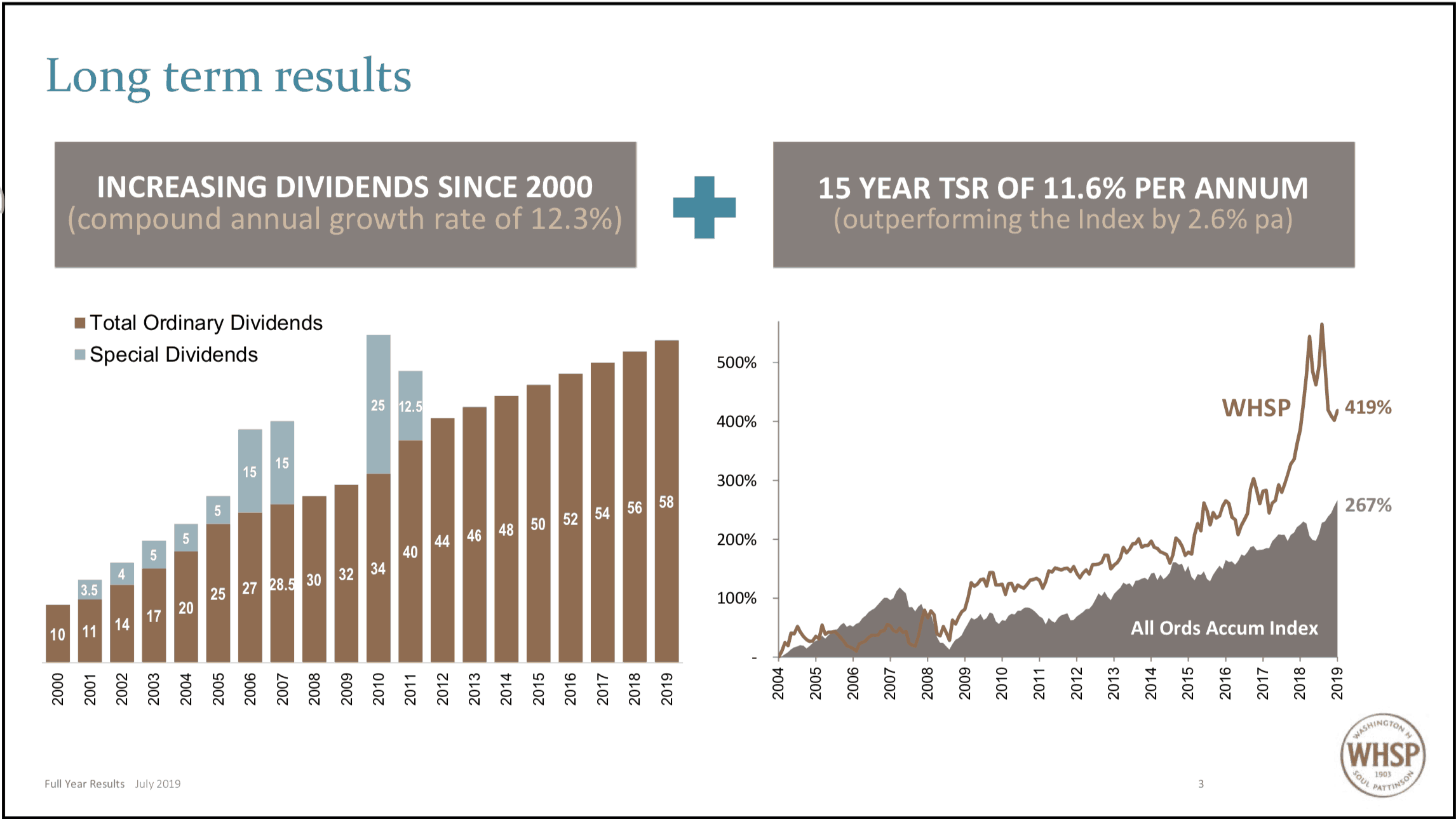

It will pay a final dividend of 34 cents per share to take full year dividends to 57 cents per share on earnings of $1.035 per share to mean it has lifted its interim and final dividend every year since 2000.

Share prices tend to follow earnings higher or lower over the long term and earnings pay dividends, with the Soul Patts share price up from $3.60 in September 2000 to $22.29 today. And that's before the incredible streak of rising dividends.

That winning run has gone right through the GFC of 2008/09, which was a period when other dividend favourites like Westpac Banking Corp (ASX: WBC) or Commonwealth Bank of Australia (ASX: CBA) were forced to axe payouts.

Only healthcare player Ramsay Health Care Limited (ASX: RHC) has a comparable dividend streak to Soul Patts.

Notably, Soul Patts' trailing payout ratio is only around 57% of earnings to suggest its dividend is well covered with a lower payout ratio than many more popular dividend rivals.

Source: Washington Soul Pattinson presentation, Sept 19, 2009.

The group's chairman, Robert Milner, remains frustrated by its operating environment though and commented, "Our major investments continue to be impacted by regulatory issues. After 12 years New Hope continues to await approval for its New Acland extension, TPG is before the Federal Court seeking approval for its merger with Vodafone and Brickworks continues to be impacted by the higher gas and energy prices in Australia."

Despite its reputation for stability the Soul Patts share price could be volatile in the weeks ahead as the Federal Court is due to give a decision on whether TPG Telecom Ltd's (ASX: TPM) merger with Vodafone Australia can go ahead.

Soul Patts owns 25.3% of TPG and any merger is widely expected to lead to far larger dividends over the medium term for TPG investors.

It also owns 44% of steady cashflow business Brickworks Limited (ASX: BKW) and 50% of more volatile coal miner New Hope Corporation Ltd (ASX: NHC).

Its wide range of other investments include significant commercial property investments, asset managers like BKI Investment Company Limited (ASX: BKI), Pengana Capital Group Limited (ASX: PCG) or Milton Corporation Limited (ASX: MLT) and healthcare players like Australian Pharmaceutical Industries (ASX: API).

Soul Patts maintains a strong balance sheet to support future investment opportunities and flagged asset management, retirement living, or agriculture, as areas of investment interest going forward.