The Australia & New Zealand Banking Group (ASX: ANZ) share price is up 1.5% to $27.14 today after the lender updated investors on the quality of its home loan book today.

On a high level the lender reported that wholesale funding costs creeped marginally higher in the "lead up to the Christmas period and into January", with lending volumes in the "Australia Division" declining over the quarter, and the housing portfolio contracting 0.2%.

According to the lending regulator APRA, Australia's total home loan lending growth over calendar 2018 was 4.2%, with ANZ's home loan portfolio up 1%. ANZ's investor loans fell 3.8%, with owner occupier loans up 3.5% over the year.

Many predicting an Australian house price crash have claimed that the mass switch of interest only loans to principal and interest loans over 2019 could act as a crash catalyst.

Today ANZ reported that $6.8 billion of its loans made the switch over the quarter compared to "$5.8 billion per quarter on average of the 8 quarters from Q117 to Q418".

However, what effect this switch to higher repayments for more leveraged investors has on bad debts is yet to feed through to the data.

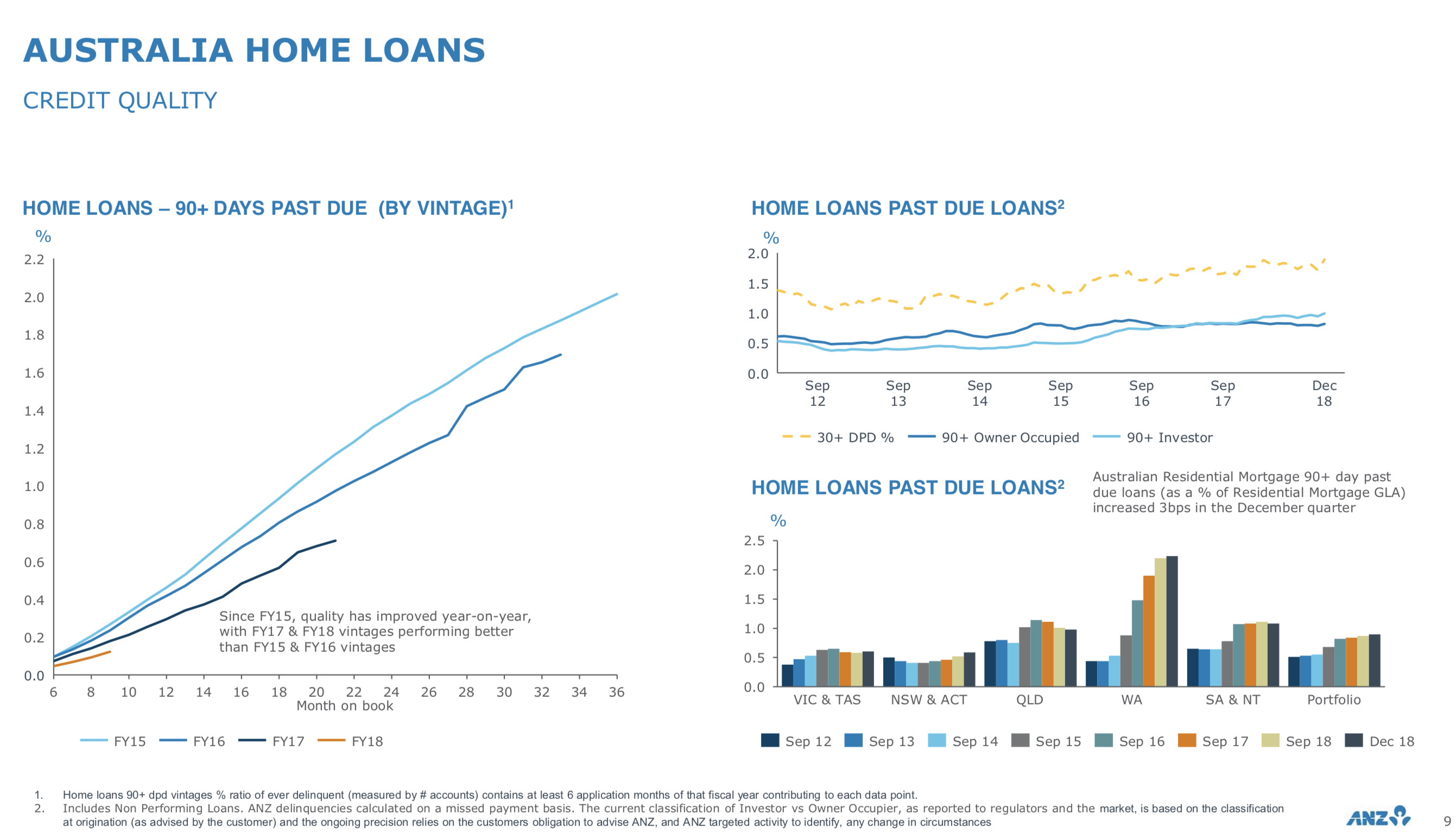

ANZ provided some backwards charts showing how "delinquent home loans" or those where borrowers were more than 90 days' late in making repayments were steadily growing, but only very marginally, with "delinquent" owner-occupier loans actually declining for the quarter ending December 2018.

Source: ANZ Bank Presentation, Feb 19, 2019.

Interested investors or home owners can take a look at more info in the presentation available on the ASX's website.

ANZ's CEO also stated the bank may have been "overly cautious" in considering lending limits recently in response to the Royal Commission and other regulatory problems with an admission that it would now look to lift lending volumes to investors.

Other major banks are also in the black today, with Commonwealth Bank of Australia (ASX: CBA) up 0.8% to $71.57 and National Australia Bank Ltd (ASX: NAB) up 1.8% to $24.66.