The Link Administration Holdings Ltd (ASX: LNK) share price traded flat at $8.69 today after the company released its half year results. Here's what you need to know:

- Revenue grew 27% to $503 million

- Net profit after tax grew 54% to $64 million

- Earnings per share grew 19% to 13.16 cents per share

- Link announced an interim dividend of 7 cents per share

- Completed Link Asset Services acquisition during the half, resulting in a major step change in revenues and debt

- Did not provide a formal outlook but stated that integration was progressing well and that there is a good organic pipeline of opportunities

So what?

It was a solid result from Link Group, which nevertheless appears to be growing primarily via cost cutting and acquisition. Excluding the acquisition of Link Asset Services, operating earnings before interest, tax, depreciation and amortisation (EBITDA) grew 6%.

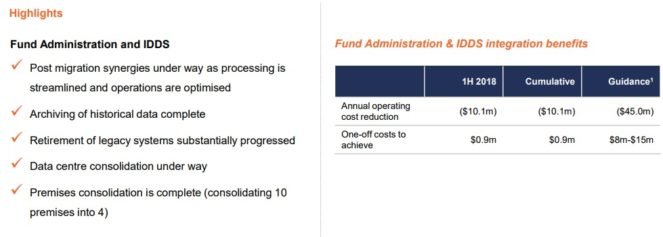

Integrating and combining business systems is expected to be a significant driver of earnings improvement in the future:

Link also noted that it has a gearing ratio (net debt divided by operating EBITDA) of 2.46x, at the upper limit of its 1.5x to 2.5x target range. Management stated that this level of debt 'provides flexibility for future growth.' Link reported 89% of its revenues were recurring, which may allow the company to safely borrow more heavily than otherwise. Still, I don't like seeing companies borrow heavily with no real plan for paying it back.

Now what?

I've been persistently bearish on Link Group since it listed, primarily because I think much of the improvements to come are already priced in to the company. Maybe I have been too bearish – shares are up 22% since it launched on the ASX – but I'm still not convinced it's a standout opportunity.

With recurring revenue and prudent use of debt, potentially Link could build a nice business by acquiring smartly and consolidating the industry. I am aware of that possibility, but I am still not particularly excited by Link today and I continue to watch from the sidelines.