ARB Corporation Limited (ASX: ARB), Pro Medicus Limited (ASX: PME) and Gentrack Group Ltd (ASX: GTK) shares are still on my 2017 watchlist.

2017 performance

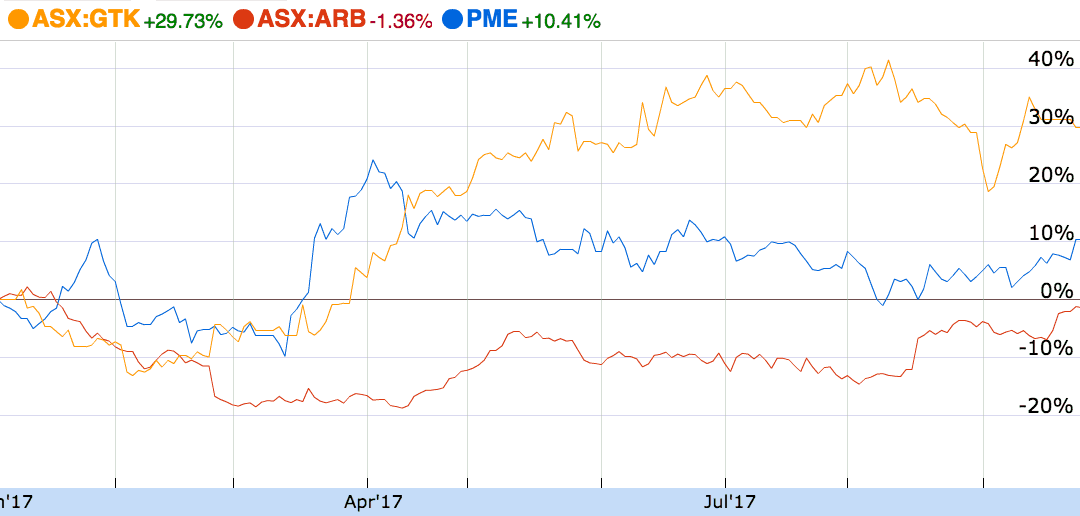

As can be seen above, these three ASX shares have performed well in the past six months, despite ARB shares trading lower since January.

Here's why these three companies are still on my watchlist in 2017.

ARB Corp

ARB is Australia's leading bullbar and 4×4 parts specialist. With manufacturing sites in Melbourne and Asia, ARB is known for safety and design. In addition to its Australian network, the company has expanded into Europe following a successful initial rollout. It is also in the early stages of expansion in the USA and the Middle East. While success is far from guaranteed, each of these markets is a compelling target for the 4×4 company.

Although I'm not buying ARB shares due to their current valuation, I am patiently waiting for a better opportunity so I can add a small position in ARB shares.

Pro Medicus

Pro Medicus is a small-cap health technology company, operating out of Richmond in Melbourne's outer east. The company offers an imagery solution for doctors and radiologists, allowing them to send and receive files like X-Rays in a matter of seconds.

Pro Medicus' technology is sold globally, having met the security and regulatory standards to enable doctors to diagnose patients based on the medical images in the palm of their hand.

Shares do not come cheap but Pro Medicus appears to be a compelling long-term prospect in my opinion.

Gentrack Group

Gentrack is a Kiwi software business, with operations around the world including the UK. Gentrack develops and sells software to airports and energy and water utilities. The company's software integrates with their clients' processes, making it a more valuable tool over time.

Although its shares have rallied strongly in 2017 I think Gentrack could have a brighter future ahead of it.

Foolish Takeaway

I do not hold a position in these three companies' shares. However, if — or when — their valuation improves I will consider adding some to my portfolio. Until then, they will stay on my watchlist.