The Coca-Cola Amatil Ltd (ASX: CCL) share price has continued its recent falls, but I still can't bring myself to buy any for my portfolio.

Coca-Cola Amatil: Losing Fizz

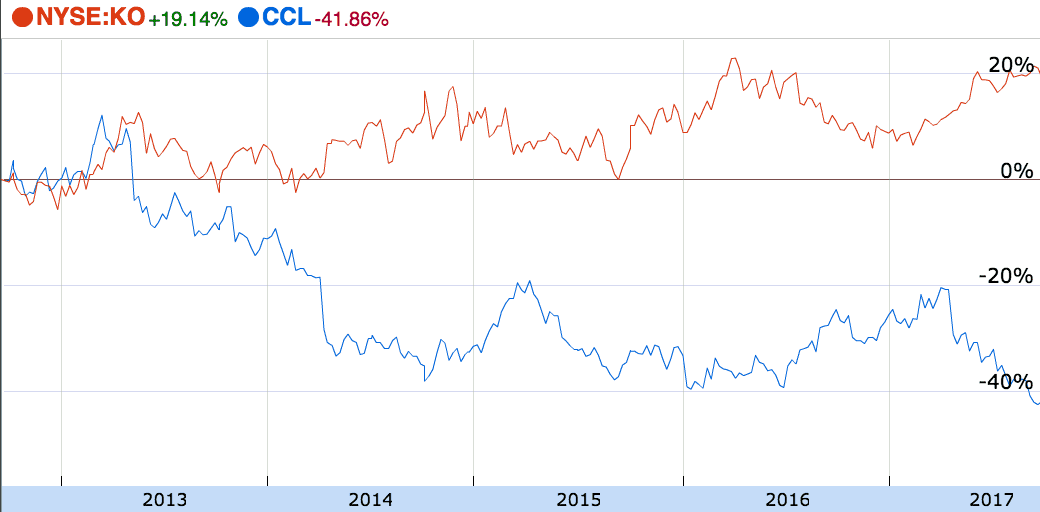

The above chart compares Coca-Cola Amatil, the Australian and Kiwi distributor of Coca-Cola and other products; and The Coca-Cola Company, which owns the global rights to the brand. It is also a major shareholder in the Australian distributor.

As can be seen, it has been a tough run for Coca-Cola Amatil shareholders over the past five years.

Some might argue Amatil's woes initially appeared with the rise of a healthier consumer and a resurgent marketing campaign by PepsiCo Inc.

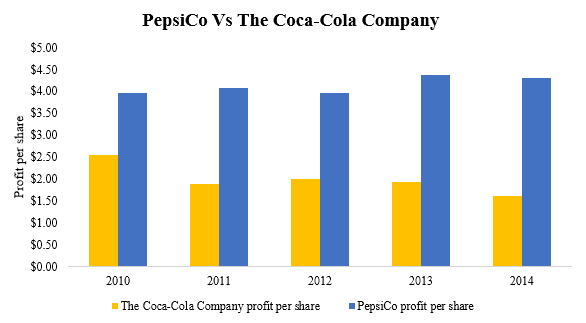

Two years ago, I published this chart:

It shows Coca-Cola Company's profit per share falling over time, while PepsiCo appears to be gaining ground.

Since then, The Coca-Cola Company's profit per share has continued to fall while PepsiCo's is higher than it was two years ago.

Closer to home, Amatil's sales have remained quite steady and a fresh injection from its global parent should have bolstered its marketing efforts. Unfortunately, its profit is down.

That's why, using ratios, Amatil's shares still appear expensive despite the fall from grace.

Foolish Takeaway

With more consumers demanding healthier products, in a saturated and competitive market, I find it hard to see Coca-Cola Amatil shares going on to be a comprehensive market-beating investment. That's why I'm looking elsewhere for new investment opportunities, at least until we see some signs of a turnaround in its fundamentals.